Who is Charlie Munger?

- Charles Thomas Munger, known as the right hand of Warren Buffett, vice chairman of Berkshire Hathaway, was an American investor born on the 1st of January 1924. As Buffett describes Munger was the architect of modern Berkshire Hathaway’s business philosophy.

- Charlie Munger was a self-taught genius. He can easily understand any subject by reading books. He had created a $2.6 billion net worth when he died & was ranked as the 1,182nd richest person in the world.

- Charlie Munger created his investment fund between 1962 & 1975 where he achieved an annual average return of 19.8% & later he joined Warren Buffett to build the largest investment company in the world, Berkshire Hathaway. But he didn’t do this through conventional textbook-type investing, he built his path to making money in the market.

Find Mispriced Companies

- When investing Munger is looking for a mispriced gamble. “You’re looking for a mispriced gamble, that is what investing is & you have to know enough to know whether the gamble is mispriced. That is value investing.”

- Finding a mispriced stock, and gamble is not very easy when it comes to a bull market. But once we find mispriced one we should invest heavily. Charlie Munger heavily invested in his lifetime on many occasions. When he met Warren Buffett he heavily invested in Buffett, when he founded Costco he did the same thing, he heavily invested in Li Lu’s fund & recently he heavily invested in Chinese stocks.

Buy Great Companies For Fair Prices

- The strategy Munger used in his entire life was buying high-quality companies for reasonable prices. He developed this mental model as he learned by reading & experimenting in real life. This strategy was so effective that he changed Warren Buffett’s fundamental value investing approach.

- Before Warren met Munger Buffett followed Ben Graham’s fundamental value investing for decades. He made money using Ben Graham’s strategy. With Ben Graham’s approach, Buffett only bought cheap companies. But Munger convinced him that this was not the right way to go about investing for the long term.

“Forget what you know about buying fair businesses at wonderful prices, instead buy wonderful businesses at fair prices.”

Charlie Munger

- With Charlie Munger’s strategy, Berkshire built its investing empire. As a result of this investing approach, Berkshire bought Apple, Coca-Cola, American Express, Moody’s, Bank of America, etc.

- In the economic recession period, bad businesses go out of business but a good quality business will survive & when it meets its right economic conditions it will create more money.

Avoid Crypto

- Charlie Munger always informs investors not to put money in crypto.

“In my life, I try & avoid things that are stupid, evil & make me look bad in comparison with somebody else. Bitcoin does all three.”

Charlie Munger

- Not only Charlie Munger but also Warren Buffett, and Bill Gates are not big fans of crypto. They think that crypto is a bubble & it will burst at any moment. On the other hand people like Elon Musk, Chamath Palihapitiya, and Cathie Wood support to promotion of cryptocurrency.

- Both these groups are genius, high-quality people. But when it comes to crypto they have different opinions. If you are young & high-risk it is not a big problem to put a maximum of 5% of your net worth into crypto. But that amount should be an amount which you are ready to lose 100%.

Too Much Diversification Is Not Good

- Charlie Munger has two portfolios. One is his portfolio & second is the portfolio that he manages at the Daily Journal Corp. The Munger family portfolio only has 4 stocks. Berkshire Hathaway, Costco, Daily Journal & Li Lu’s Fund.

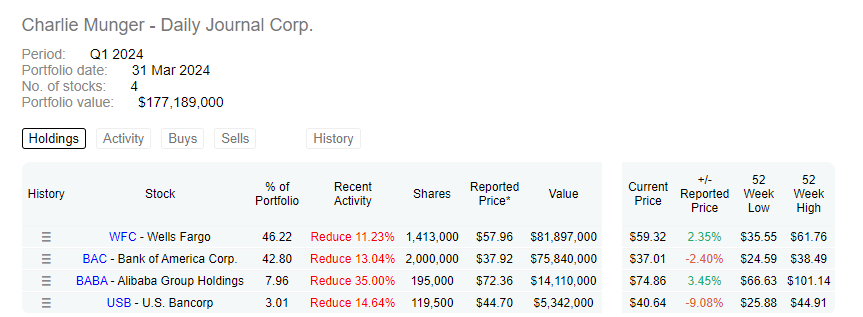

- The portfolio he manages at the Daily Journal also only has 4 stocks. Wells Fargo 46.22%, Bank Of America 42.8%, Alibaba Group Holdings 7.96% & U.S. Bancorp 3.01%.

- The Munger approach is only to find a few good opportunities & then bet very heavily on them. He has said that he finds it easier to focus on 4 assets where he has a high probability of getting it right than on a 100.

“I think the great lesson from the Mungers’ is you don’t need all this diversification. That’s plenty of you’re lucky if you’ve got four good assets. I think finance professors & that perfect diversification is a professional investment. If you are trying to do better than average, you are lucky if you have four things to buy & to ask for 20 is asking for an egg in your beer.”

Charlie Munger

Pingback: A Deep Look Into Berkshire Hathaway: Warren Buffett - financialcloning.com

Pingback: Why Charlie Munger Bought Alibaba Stock? - financialcloning.com

Pingback: How to Think Like Warren Buffett - financialcloning.com