Let me start this conversation by pointing out some facts. From 1967 to 2023 the average compounded return given by this company is around 20%. You may ask what is the big deal about generating 20%, it’s a small number, even I can generate more than 20%. Please let me explain the math behind this. Indeed, you may already have more investment return than 20%, but how long have you been compounding, may 5 years, 10 years, 15 years? But this company is compounding 20% for the last 55 years. Can you imagine that?

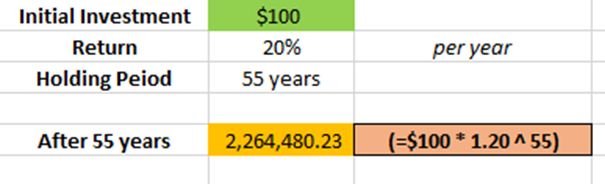

Let’s make the math simple. Let’s say you invested $100 in this company in 1967 & let the investment compound for the next 55 years & assume that you never touch this investment & you never put a single dollar again.

In 2023 you have $2.2 million. Your $100 initial investment has turned into $2 million. Nice ah. Berkshire Hathaway is the company that made this amazing return.

Berkshire Hathaway

The greatest value investor of all time, Mr. Warren E. Buffett is the chairman of this company. Vice Chairman is his best friend & his mentor who passed away last year Mr. Charles T. Munger. These legendary investors have built the best investment company on the planet Earth for the last 55 years.

Berkshire Hathaway is a textile manufacturing company built in 1839. In 1962 Warren started buying stocks in Berkshire to just buy & sell. Eventually, Warren understood that the textile business was dawning & so he acquired Berkshire & made investments in other businesses through Berkshire. In the late 1970s, Berkshire acquired GEICO. In 1985 they shut down the textile business from 1985 to today Berkshire has had an investment company.

Berkshire Hathaway Portfolio

| Company | Berkshire Portion | Company Ownership |

| AAPL – Apple Inc. | 50% | 6%, 3rd shareholder |

| BAC – Bank of America Corporation | 9% | 13%, Top shareholder |

| AXP – American Express Company | 7% | 21%, Top shareholder |

| KO – The Coca-Cola Company | 7% | 9.25%, Top shareholder |

| CVX – Chevron Corporation | 6% | 6%, 4th shareholder |

| OXY – Occidental Petroleum Corporation | 4.5% | 25.5%, Top shareholder |

| KHC – The Craft Heinz Company | 3.5% | 26.5%, Top shareholder |

| MCO – Moody’s Corporation | 2.5% | 13.5%, Top shareholder |

| DVA – DaVita Inc. | 1% | 39.5%, Top shareholder |

| Sector | Berkshire Portion |

| Technology | 50% |

| Finance | 21% |

| Consumer Staples | 11.5% |

| Energy | 10.5% |

| Other | 7% |

- Currently, Assets Under Management in Berkshire are $313 billion, they have $157 billion cash in their hand.

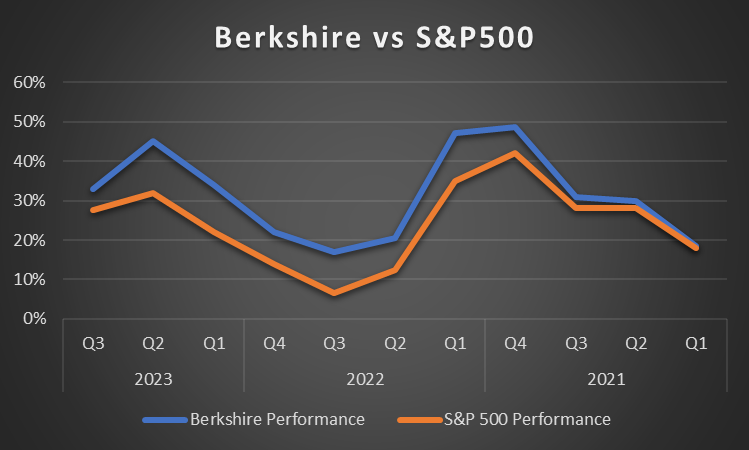

Berkshire Hathaway vs S&P 500 Performance

| Year | Quarter | Berkshire Performance | S&P 500 Performance |

| 2023 | Q3 | 33% | 27.5% |

| Q2 | 45% | 32% | |

| Q1 | 34% | 22% | |

| 2022 | Q4 | 22% | 14% |

| Q3 | 17% | 6.5% | |

| Q2 | 20.5% | 12.5% | |

| Q1 | 47% | 35% | |

| 2021 | Q4 | 48.5% | 42% |

| Q3 | 31% | 28% | |

| Q2 | 30% | 28% | |

| Q1 | 18.5% | 18% |

Pingback: How to Build a Stock Portfolio in 2024 - financialcloning.com

Pingback: How To Make a 50% Return Per Year: Warren Buffett - financialcloning.com

Pingback: Top 3 Dividend Stocks Experts Are Buying - financialcloning.com

Pingback: How To Protect Your Investment Portfolio: Stock Market Crash - financialcloning.com

Pingback: Why Warren Buffett Is Holding Cash & Not Buying Stocks - financialcloning.com

Pingback: How To Invest Your Money: Charlie Munger - financialcloning.com

Pingback: How To Achieve A High Investment Return: Warren Buffett - financialcloning.com

Pingback: A Look Into Apple Stock: 2nd Largest Company In The World - financialcloning.com

Pingback: A Deep Look Into Occidental Petroleum: Why Warren Buffett Is Heavily Investing - financialcloning.com