If we look at the Daily Journal Corp. the company they managed until he died, he bought 195,000 shares of Alibaba stock on the New York Stock Exchange worth 8% of his entire portfolio. This investment is the 3rd largest investment in total.

Why Alibaba?

After not making any investments over a couple of years in 2022 Munger suddenly bought into Alibaba stock. When we consider the price of the stock it has fallen from all-time-high $317 per share in 2019 to $80 per share today in 2024. It has fallen more than 70%. When it comes to retail mindset everyone is panicking with such a thing. But in 2022 Charlie made a bold decision to buy the stock.

The reasons to fall the stock

Investors are worried about the Chinese government & the power that they have over the private sector. They worry about the regulations over business operations, the VIE structure, and the potential de-listing. There are a lot of factors they’re concerned about. This is why many Chinese stocks are down by more than half of the price of companies.

Tencent Holdings Limited, China’s largest & most powerful company down from $90 to $47, 63%. Baidu stock, Chinese Google down 62%, and JD stock, Chinese Amazon down by 65%. Huge crashes in every Chinese stock.

But when it comes to the opinion of Munger about Chinese stocks he had a different opinion.

“I think that the Chinese government will allow businesses to flourish. It was one of the most remarkable things that ever happened in the history of the world when a bunch of committed communists just looked at the prosperity of places like Singapore & said, with this, we’re not going to stay here in poverty, we’re going to copy what works & they changed communism. They just accepted Adam Smith & added it to their communism. Now we have communism with Chinese characteristics which is China with a free market with a bunch of billionaires. They made that shift.”

Charlie Munger

Munger didn’t care about the country of politics of the country. He wanted the business is make money.

Financial Performance

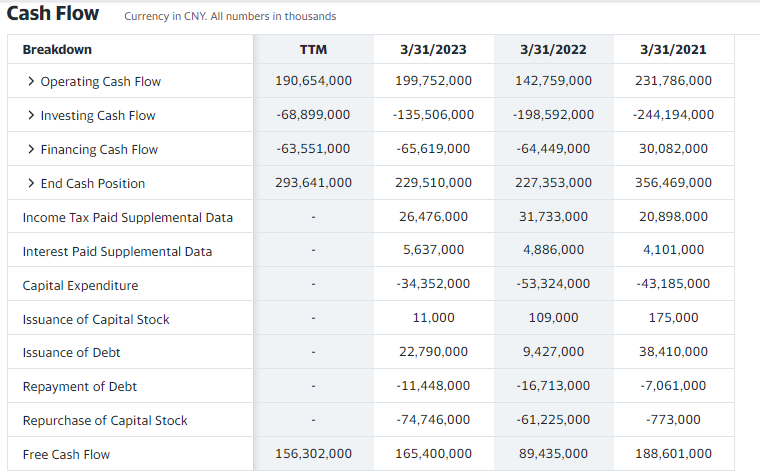

Alibaba is a cash flow machine. Let’s look at some numbers. Free cash flow has seen some impressive growth over the past few years. It’s gone from 89.4 billion CNY in 2022 to 165.4 billion CNY in 2023.

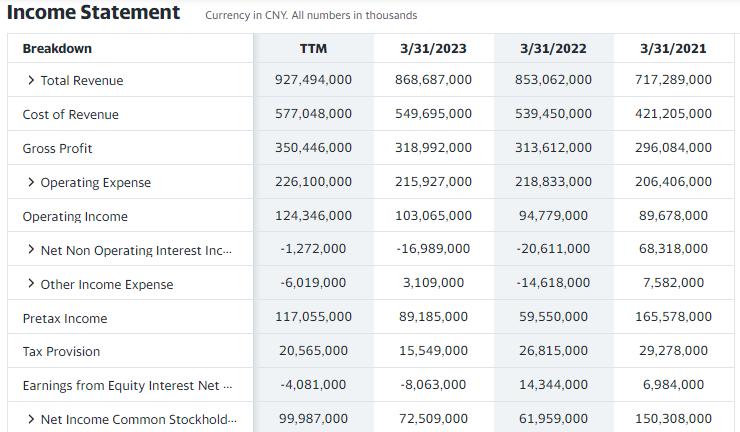

Revenue also tells a similar story. Revenue in 2021 is 717 billion Yuan has grown from 853 billion Yuan in 2022 to 868 billion Yuan in 2023. Year after year they have grown their topline.

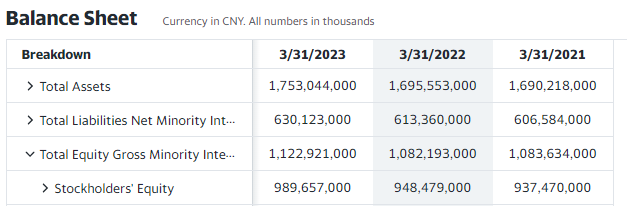

Shareholders’ equity is also a good metric to identify the growth of the business. The equity figure has grown from 937 billion Yuan in 2021 to 986 billion Yuan in 2023.

All these underlying financial numbers have been going up. The only thing that hasn’t gone anywhere is the stock price. Alibaba stock is selling for the same price of $80 that it was selling for in 2014. Within the last 10 years, the stock has gone nowhere. But the financials tell a different story. This doesn’t make sense from a financial standpoint.

This is a big reason why Munger has put money into Alibaba.

Business Performance

Alibaba’s core business is a very strong one. If China don’t have Alibaba they lose so much of their e-commerce trade as a nation. Alibaba makes up 40% of Chinese e-commerce with 903 million active consumers on Chinese retail marketplaces.

They have Taobao, Tmall & 1688 for Chinese individual consumers & businesses, and they’ve got Alibaba & Ali Express for their global consumers. Alibaba owned Lazada, Lazada is the largest e-commerce platform for South East Asia.

Cloud Computing

In the long term, a lot of the value creation for Alibaba is cloud which is non-existent from an earnings perspective today. When it comes to cloud margins they are incredible & Alibaba has a huge advantage & bright future when it comes to cloud computing.

The issue with the cloud is that only a few people can play in this market. Alibaba has capital ^& technology to make some oligopoly in the cloud computing segment.