Investing like Warren Buffett requires more than just financial knowledge, it demands extreme patience, financial discipline & deep understanding of investment philosophy.

To be a great value investor like Warren Buffett is not just a skill-based game, it is a mental game you need to play very long time. Let’s discover the path to being a value investor step by step.

A Lifetime of Investing

From the age of 11 to today at age 93, his investing journey has shown incredible patience & persistence. He started small but steadily grew his investment over 8 decades. This is the type of patience you need to absorb if you are going to be a great value investor.

Over an 8-decade period, with market ups & downs, economic collapses, world wars, market bubbles & lots of financial mistakes he managed to navigate through each situation & become one of the greatest billionaire value investors of all time.

From Mentorship to Mastery

Warren Buffett’s journey into value investing began with the guidance of Benjamin Graham, whose seminal work ‘The Intelligent Investor’ shaped his approach profoundly.

Graham’s mentorship helped him to view stocks as a portion of businesses & a philosophy of intelligent value investing rather than speculative trading.

Central to Graham’s teachings was the concept of ‘Mr. Market’, symbolizing the erratic nature of stock prices. Instead of reacting to daily stock price fluctuations,

Warren learned to use Mr. Market, patiently awaiting favorable opportunities aligned with long-term investment goals.

This fundamental wisdom not only guided his path to becoming the richest person on the planet but also influenced subsequent generations of value investors.

The Evolution of Investment Philosophy

Under the mentorship & partnership with his loving friend Charlie Munger, they built the world’s most successful investment firm ever created Berkshire Hathaway now worth over $800 billion.

Munger’s mentorship shifted Warren’s approach from Graham’s emphasis on buying undervalued stocks with a margin of safety, to a focus on acquiring exceptional companies at reasonable prices.

This transformation marked a pivotal shift towards holding onto quality businesses for the long term, rather than seeking short-term gains.

The Value Investors’ Treasury Hunt

Warren Buffett’s commitment to reading is exceptional. He reads 500 pages daily, absorbing insights from books, annual reports & newspapers, a habit he maintains even at age 93.

Once a solid value-investing mental model is established, continued knowledge-seeking becomes essential to deeply understand businesses.

Buffett reads each company’s annual reports for the last 10-20 years & tries to understand how the business works. If he was able to understand the business & found attract to buy he invested his money to buy the stocks.

Once invested, Buffett advises holding stocks until their price exceeds rational levels. Buffett’s approach involves digging into each company, akin to a treasure hunt.

For true value investors, this process is not just a duty but a joyous exploration.

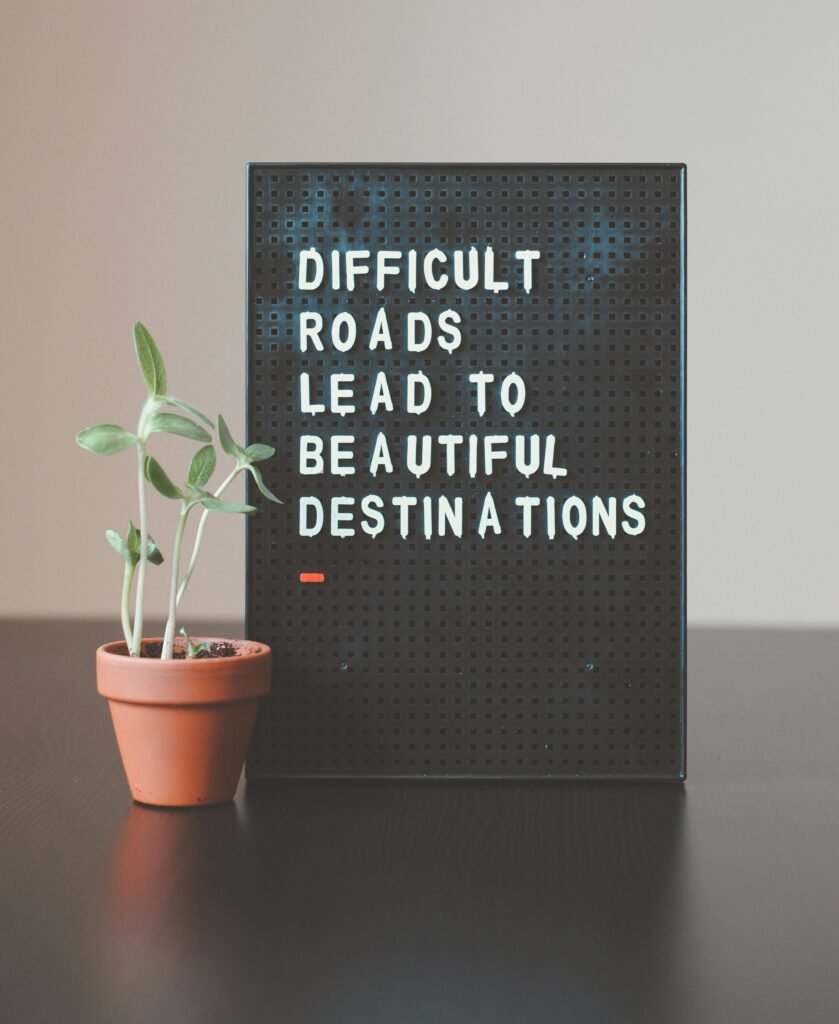

Embracing The Buffet Mindset

Thinking like Warren Buffett is not an overnight endeavor, it is a lifelong journey of absorbing the right mindset & philosophy.

Fundamental principles in value investing such as understanding Mr. Market, employing a margin of safety, focusing on great companies with reasonable prices & avoiding speculation are core tenets that guide Buffett’s approach.

Becoming a value investor requires diligent research, reading extensively & thinking like a prudent business owner rather than a mere trader.

Once you absorb these things you will become a value investor & it will lead you to massive financial success.

Pingback: Which is the Best Way to Learn About Stocks? - financialcloning.com

Pingback: Why Invest $1,000 Instead of Spending - financialcloning.com