- A stock market crash is something that most investors fear. Even today there are certain indicators used by experts that there is a possibility of a recession.

- So, the question we need to ask ourselves is how do we prepare our investment portfolio for a crash? We can see what great investors like Warren Buffett, do before a recession & how they behave during a recession.

Keeping Cash & Cash Equivalents

- Cash equivalents mean treasury bills that is what Warren Buffett has a lot of his cash in. Warren Buffett used cash as a hedge in a stock market crash.

- When things are going well, the stock market is booming what Warren does is he is collecting dividends & using that cash he is buying treasury bills.

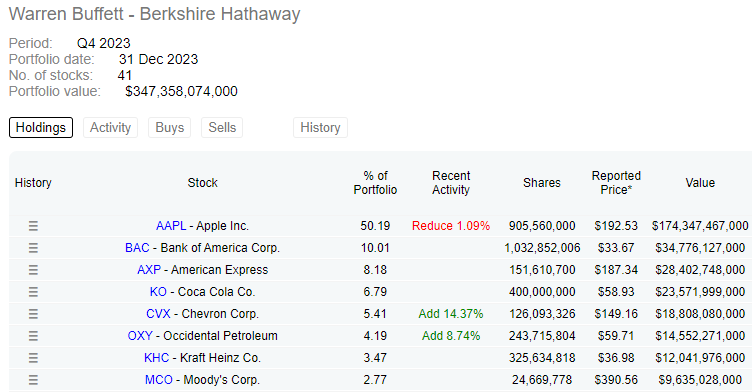

- Berkshire Hathaway, Warren’s investment firm currently holds $168 billion cash & cash equivalents. Some developing countries’ GDP is also less than this number. Like the GDP of Ukraine is $161 billion, the GDP of Oman is $115 billion. So, Berkshire currently holds lots of cash right now.

- When the market was rising from 2002 to 2007, when he was struggling to find cheap stocks to buy he put that extra cash in treasury bills.

- When the stock market finally crashed in 2007 to 2009 Warren Buffett had cash on hand to buy stocks when they were cheap. His cash did not crash as treasury bills were still earning interest. He had the perfect opportunity to buy because he was smart the previous time.

- That is why it is so important to have some of your portfolio in cash during these market conditions because if stocks do crash then you have money to buy stocks when they are cheap.

Keeping Dividend Paying Stocks

- Is there any stock group performance better than in a stock market crash? Yes, there are some groups of stocks performance well during the market crash & one of the groups is Dividend Aristocrats stocks.

- The Dividend Aristocrats are S&P 500 index constituents that have increased their dividend payouts for 25 consecutive years or more. By seeing the data table you can have some basic understanding.

- Over the long term, Dividend Aristocrats have achieved a higher average return S&P 500.

| Year | S&P 500 Dividend Aristocrats Performance | S&P 500 Performance |

| 2000 | 10.1% | -9.1% |

| 2001 | 10.8% | -11.9% |

| 2002 | -9.9% | -22.1% |

| 2008 | -21.9% | -37% |