- The majority of people in this world are not financially stable. One government study tracked people from the ages of 20 to 65. By the time they turned 65 years old, the study found that:

1% were wealthy

4% were well off

5% were still working because they had to

54% were living on support from family or the government

36% were dead

- More than 35% of that wealthy 1% inherited their wealth, as did a large percentage of the 4% who were well off. The question we need to ask is, what did the top 5% of the rich do that the others did not? What price did the 5% pay that the others did not?

1. Spending more than You earn

- The most basic mistake a lot of people make when it comes to spending money is they spend more than what they earn. It is not a question about how much money you earn. It is all about how much you save & how much you invest.

- Let us see some basic examples. Let’s say that John is a software engineer who makes $100,000 per year but still cannot live on his paycheck. His annual expense is $20.,000. Peter is a school teacher who only makes $50,00 per year but every year he manages to save $10,000 or more per year. As you can see it doesn’t matter John earns twice as Peter, Every year he has to borrow an extra $20,000 to cover his expenses. On the other hand, Peter does not need to borrow.

- Charlie Munger, one of the greatest investors who passed away recently said,

“It’s so simple to spend less than you earn, & invest shrewdly, & avoid toxic people & toxic activities, & try to keep learning all your life, & do a lot of deferred gratification.”

Charlie Munger

2. Not Investing Your Money

“Inflation is when you pay $15 for the $10 haircut you used to get for $5 when you had hair.”

“Inflation is taxation without legislation.”

“Inflation makes the wealthiest people richer & the masses poorer.”

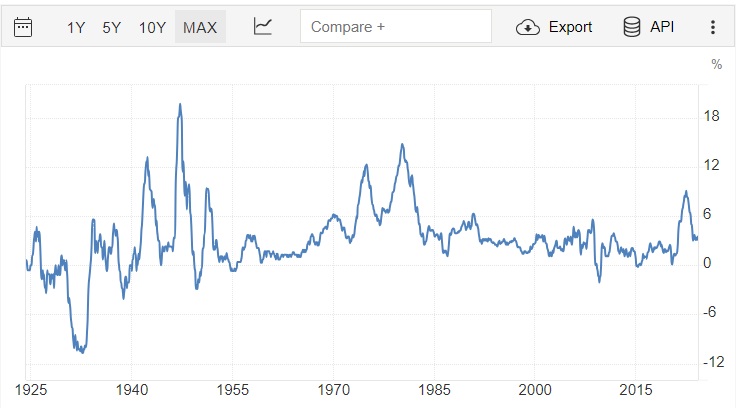

- These are some famous quotes about inflation. Inflation is not a good friend with money. No matter how much you save past inflation can eat your savings with time. That is why you need to invest your savings in inflation hedge investments.

- Here are some inflation hedge investments. Gold, Stocks, Bond, Real-Estate. As retail/small investors it is good to build a diversified investment portfolio with your savings. You can buy some stocks, bonds, gold, cryptocurrency, and cash.

- You can learn basic rules about investing in stocks for free. One of the greatest investors of all time Warren Buffett’s speeches about investing are free and available on YouTube.

3. Not Avoiding Bad Debt

- What do we mean by bad debt? Is there any good debt? Yes, debt can be good or bad according to your purpose of using the debt.

- Most people use debt to buy a vehicle or house. Only for consuming purposes. These types of things do not make money. You have to spend your monthly income to pay debt.

- Some people use debt to buy properties or to buy some assets for their business. These assets produce cash flow over time & they can pay their debt & interest from that cash flow.