The Misconception of Get Rich Quick

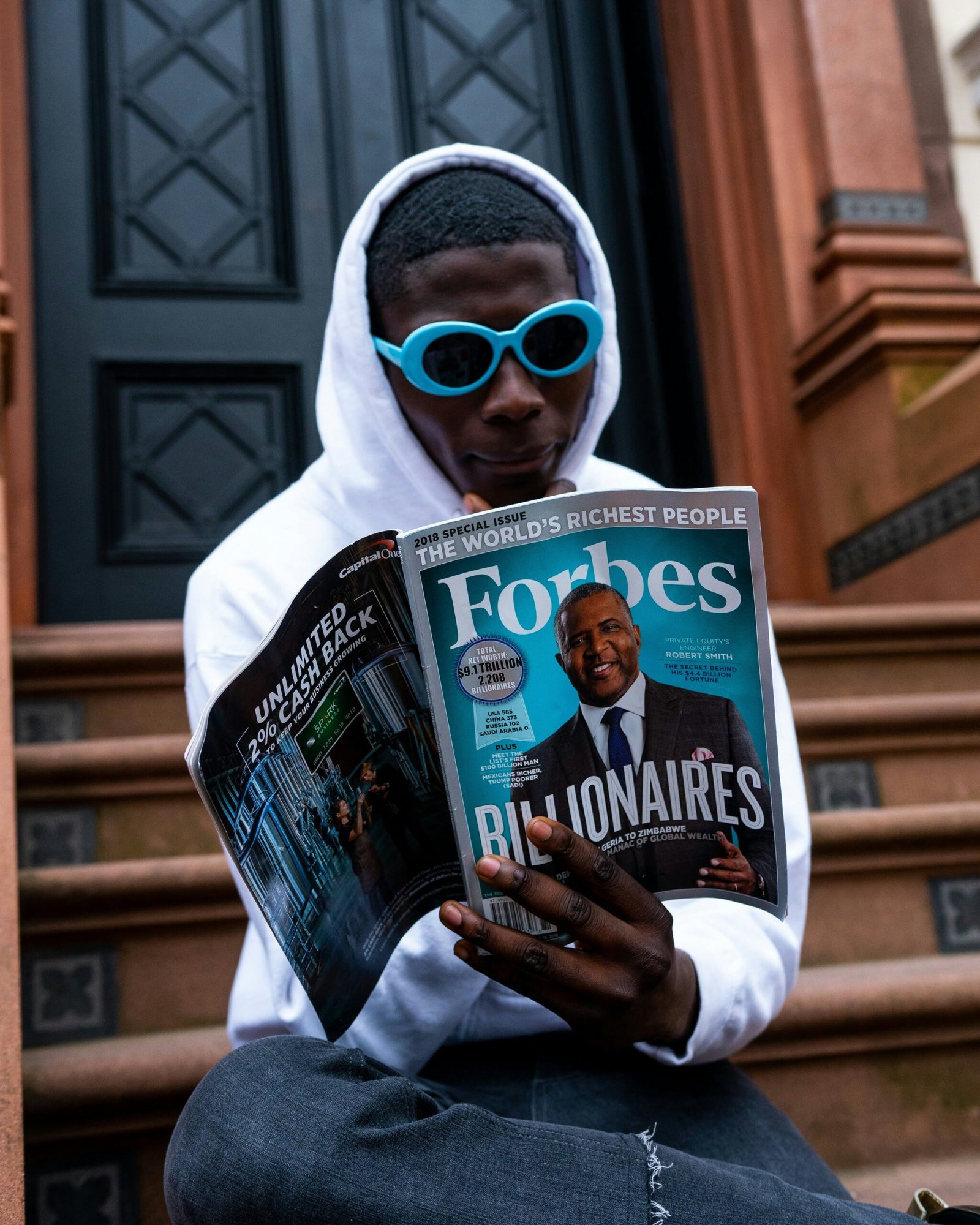

Many young people today aspire to become rich quickly and achieve financial freedom at an early age, often influenced by social media where success stories of young millionaires are common.

These platforms frequently showcase individuals who claim to have amassed wealth through investments in stocks or cryptocurrencies, often accompanied by displays of luxury cars and lavish lifestyles.

However, this can lead to the misconception that getting rich is easy and requires little effort or education. In reality, building substantial wealth usually involves significant hard work, persistence, and a solid understanding of financial principles, highlighting the importance of real-world education and informed decision-making.

How to Generate Money

To create wealth and become rich, acquiring knowledge and skills is essential. You need to be skilled to generate money, whether through a career or a business.

The issue with having a career is that it typically offers a fixed salary, while a business can generate limitless cash flow, depending on your knowledge and skills.

However, many people are not ready to start or run a business. Some pursue business ventures believing it’s the easiest path to quick riches, but this isn’t always true.

While businesses can indeed generate substantial income, many also fail. Therefore, my advice is to ensure you have the right mindset and knowledge about sales and marketing before starting a business.

A company’s revenue and profit depend on the quantity of products sold and their prices. The basic formula for sales is profit = unit profit * quantity.

To sell products, you need a quality product, which might involve creating it yourself or sourcing it from suppliers. Advertising and marketing your product is crucial, and you must determine the best marketing strategy, utilizing social and digital media.

These are fundamental steps, but there are many more considerations before starting a business.

Invest Your Money Wisely

No matter how much money you make, if you don’t know how to protect or grow it, you won’t become wealthy or even be able to retire.

To protect and grow your cash flow, you need to invest. In today’s world, there are many asset classes to choose from, including stocks, bonds, gold, real estate, and cryptocurrencies.

Regardless of which asset classes you choose, it’s crucial to understand basic investing principles.

As Warren Buffett, one of the greatest investors, famously said: “The first rule of investing is never lose money, and the second rule is never forget rule number one.”

You cannot afford to lose your hard-earned money from your profession or business, so you must be cautious with your investments.

Once you receive your monthly paycheck or profit, the first thing you should do is allocate a portion of your income to investments.

If you’re a passive investor, you might consider putting your money into an index like the S&P 500.

If you’re a well-diversified investor, you can spread your investments across different asset classes. For example, you might allocate 40% to stocks, 30% to bonds, and 30% to real estate. The allocation depends entirely on your situation.

Overview

Becoming rich and wealthy is not a game of overnight success; it takes time and patience. No matter how eager you are to achieve financial freedom, you must allow your career or business to mature to generate sufficient cash flow.

Investments need time to grow, and you must allow compounding to work its magic on your hard-earned money. Without this patience, the path to wealth requires significant sacrifices.

You might need to cut expenses to save more money, work late nights, and forgo happy weekends to earn extra income. You may have to sacrifice time with family and friends to build your business and advance your career. Investing in education about sales, marketing, investing, and trading often requires both time and money.

The journey to wealth is filled with sacrifices and sleepless nights; it’s not a path lined with roses but rather one full of challenges.

If you’re ready to embrace these challenges, then you’re truly prepared to get rich.