What is Netflix?

Netflix is a subscription video-on-demand internet streaming service all over the world.

In more than 190 countries Netflix is providing its video streaming services & Netflix is the most-subscribed video-on-demand streaming service with over 269.6 million paid memberships.

Netflix was founded by Marc Randolph & Reed Hastings in 1997.

How does Netflix generate money?

Netflix primarily derives its revenue from subscription plans, comprising approximately 90-95% of its income. Subscriptions offer varying tiers—Basic, Standard, and Premium—allowing streaming on different devices in various resolutions.

The remaining 5-10% of revenue stems from content licensing and partnerships. Netflix secures rights to third-party content, bolstering its extensive library alongside original productions.

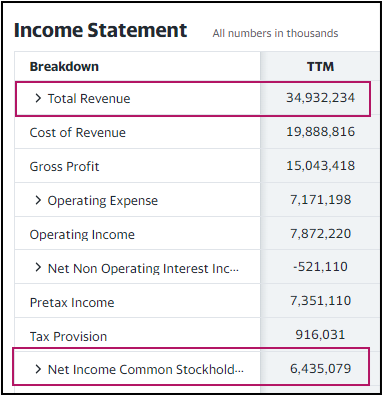

How much money does Netflix make?

In the last 12 months, Netflix reported total revenue of $34.9 billion, marking a significant increase from $24.9 billion in 2020. This growth reflects the company’s robust expansion and strong subscriber base.

For the fiscal year 2023, Netflix achieved a net profit of $6.4 billion, up from $2.7 billion in 2020, indicating a remarkable 137% increase over the past few years.

The net profit margin stands at 18.3%, illustrating that for every dollar earned from its services, 18.3 cents translate into net profit for shareholders.

In a fiercely competitive video-on-demand industry, these metrics highlight Netflix’s efficient operations and sustained profitability growth.

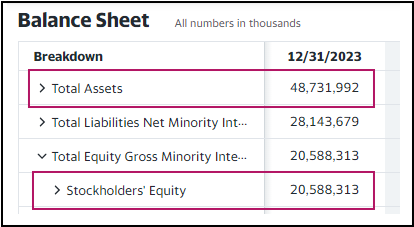

How many assets company own?

As of December 31, 2023, Netflix reported total assets of $48.7 billion.

In contrast, the company’s total liabilities amounted to $28.1 billion, with shareholders’ equity standing at $20.5 billion.

This results in a debt-to-equity ratio of 137%, indicating that Netflix owes creditors 1.37 times the amount of equity held by shareholders.

A high debt-to-equity ratio suggests significant financial leverage, which can amplify returns in favorable conditions but also increases financial risk, particularly in adverse economic or operational scenarios.

What is the current trading price of Netflix shares?

Netflix Inc. (NFLX) is currently trading on the NASDAQ exchange at $678 per share.

With an earnings per share (EPS) of $14.46, this gives the company a price-to-earnings (P/E) ratio of approximately 46.87.

A P/E ratio of 46 signifies that at the current earnings rate, it would take about 46 years for an investor to recover their initial investment through earnings alone.

Netflix has not declared a dividend this year, reflecting its reinvestment of profits into growth rather than distributing them to shareholders.

Over the past few years, Netflix’s earnings have remained relatively stable, occasionally experiencing slight decreases. Investors typically consider both the P/E ratio and dividend policy as indicators of a company’s financial health and strategy for returning value to shareholders.

Who owns the company?

As of the latest available information, Vanguard Group is the largest shareholder of Netflix Inc., holding 8.49% of the company with ownership of 36.587 million shares.

Following closely, BlackRock holds the second-largest stake with 31.3 million shares, representing 7.28% of the total outstanding shares traded.

Who runs the Netflix now?

As of the latest information, Netflix Inc. is led by two co-CEOs: Greg Peters and Ted Sarandos.

Greg Peters oversees the product, engineering, and consumer experience aspects of Netflix, while Ted Sarandos is responsible for content acquisition and creation, as well as marketing and customer service.

This dual leadership structure reflects Netflix’s approach to integrating creative and operational leadership in managing its global streaming platform and content strategy.