What is General Electric?

General Electric is an American multinational public company founded in 1892 by four co-founders including Thomas Edison.

Today 125,000 employees are working all around the world.

General Electric currently operates under four divisions: Aerospace, Energy, Healthcare & Finance.

How does General Electric make money?

As mentioned earlier General Electric has four divisions & under these divisions, they generate money.

Aerospace

General Electric is one of the leading suppliers of jet engines & integrated systems for commercial & military aircraft. They sell new engines, repair engines & sell engine components.

Energy

In the energy division General Electric has two sub-sections which include the traditional power generating segment & renewable energy segment.

In conventional power-generating areas, GE provides technologies & services related to gas, steam, nuclear & grid solutions. Here they sell gas & steam turbines, power generation equipment & sell digital software for power plant operations.

In the renewable energy segment, they focus on clean energy solutions including wind, hydro & solar power. They mainly generate income by selling wind turbines & other renewable energy equipment.

Healthcare

In healthcare, GE provides medical imaging, monitoring, biomanufacturing, and cell & gene therapy technologies. Here are some revenue models in the healthcare segment.

- Sales of MRI, CT scanners & ultrasound machines.

- Healthcare software solutions

- Life sciences tools & technologies

Finance

In the finance segment, GE offers loans, leases & other financial services to businesses.

They manage a diversified portfolio of assets focusing on optimizing returns & minimizing risks. GE finance sector offers credit risk management services & tailored financed solutions.

How much money does GE make?

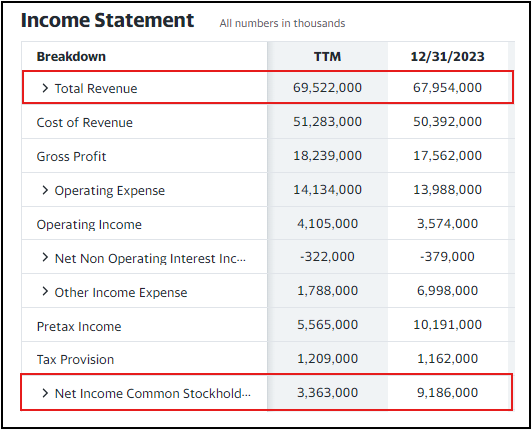

For FY 2023 the company recorded $67.9 billion in revenue & a net profit of $9.1 billion which gives a net profit margin of 13.4%.

Net operating cash flow for FY 2023 is $5.1 billion & free cash flow is $3.5 billion.

When we look at these numbers we can assume that the company is generating significant cash flow from their day-to-day business operations.

How many assets does the company have?

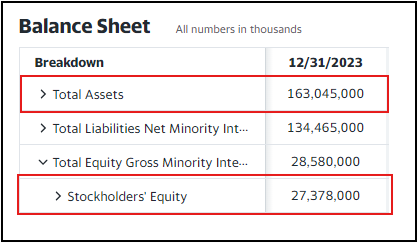

The total assets the company owns for the 31st December in 2023 is $163 billion & shareholders’ equity is $27.3 billion. The company owes $134.4 billion to its creditors. The debt-to-equity figure sits around 492%, which means the company owes 5 times its capital.

This shows that the company is highly leveraged. 83% of its assets come from its creditors. This is not a good sign because when the company hits an economic collapse it will struggle to generate money but still have to pay the debt.

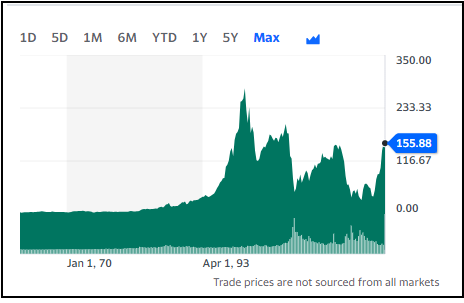

What is the current trading price of GE stock?

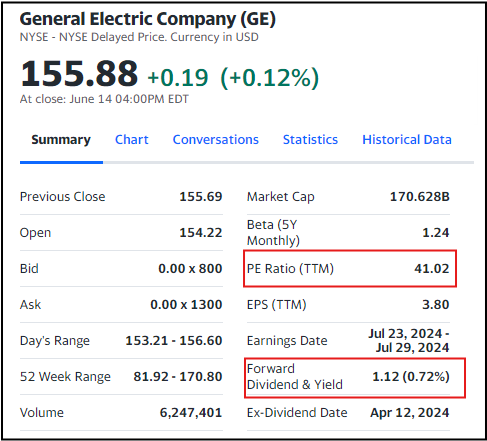

General Electric under the symbol of GE, the stock is currently trading at $156 per share, with a price-to-earnings (P/E) ratio of 41.

This PE ratio of 41 indicates that it would take 41 years to recoup your investment if earnings remain constant. For value investors like me, this is not a good number.

GE pays an annual dividend of $1.12 per share, resulting in a dividend yield of 0.72%.

The dividend payout ratio stands at 30% meaning GE distributes 30% of its earnings as dividends to shareholders & retains 70% of its earnings to expand & grow their business.

Paying 30% of earnings & reinvesting 70% of its earnings is a good sign for value investors.

Who owns the company?

Vanguard Group is the largest shareholder of the company owning 8.01% of the company & Capital Research Global Investors is the 2nd largest shareholder. They own 7.19% of the company. 3rd largest shareholder of the company is Blackrock & which owns 6.44% of the company.

Who runs the company now?

H. Lawrence Culp Jr. is the Chairman & Chief Executive Officer of GE & he is in charge of the daily operations of the company.