One of the main dreams all of us have is to become a millionaire at a young age. But when it comes to reality there are very few millionaires on the planet Earth. There will be 59.4 millionaires in the world in 2023 according to the Global Wealth Report 2023. But the total population in 2023 is around 8 billion, 8,000 million. Among 8,000 million people only 60 million people have become millionaires. 7,940 people are below the millionaire line.

So, it is not an easy, simple task to become a millionaire or retire at a very young age. You have to make sacrifices to become one of them.

1. Invest in yourself first

Once you get the paycheck in your hand what will be the first thing you are doing? Most of the time you try to pay some bills you have, maybe pay some debt you owe, sometimes you buy things you are planning to buy for a long time, sometimes you will buy some groceries, etc.

But you need to pay yourself first if you want to become a millionaire one day. What do I mean by paying yourself? You have to spend some money for yourself. You always pay first to electricity bill, internet bill, grocery bill, rent, loans, etc.

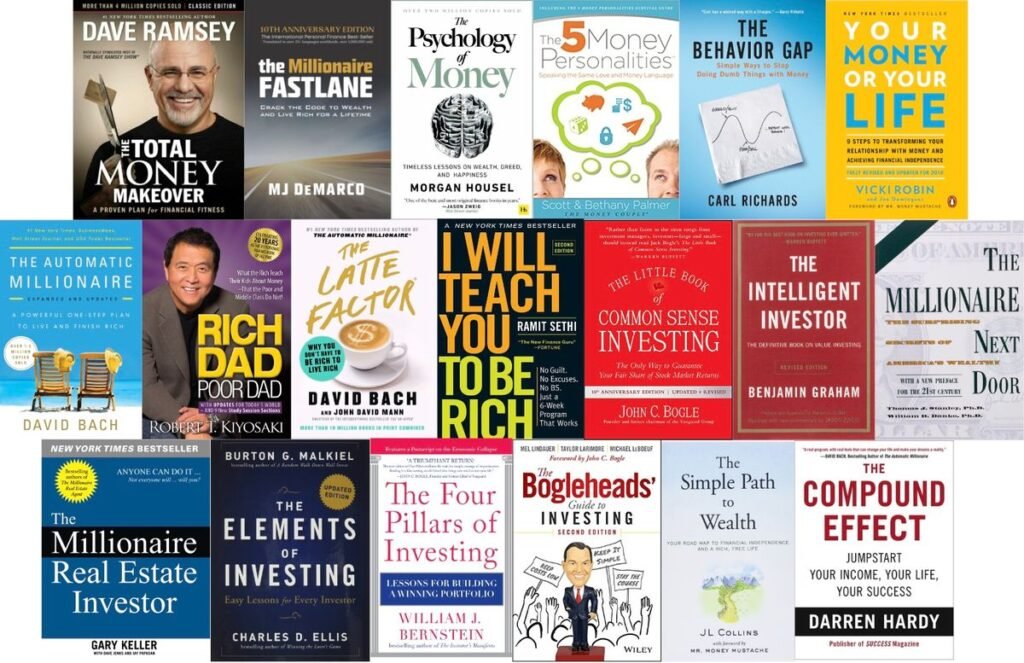

When was the last time you bought a book to read? What is the last time you invest some money in the stock market & buy a share that makes money for you? What is the last time you spend your monthly paycheck to start an online business? These are the things that you are doing for yourself. These things make money for you, these expenditures give you knowledge & skill to make, save, and invest your money.

2. Make, Save & Invest

One of the most common habit all of these millionaires has is they make a lot of money, they save most of their earnings & they invest wisely in their savings. If you are an employee your monthly, and annual earnings may be fixed. But it doesn’t mean that you cannot earn some extra income. With such a digital world you can make some extra income from your digital devices.

You can start a YouTube channel & upload videos, you can start to write a blog & publish blog articles, you can start an online store & sell products, you can start working as a freelancer. There are a lot of opportunities we all have to make some extra income. The only thing you need is your commitment to the work.

You have to be a hard saver & smart investor to build capital. Only capital can make you retire at a young age. The beauty of early retirement is that you can do whatever you want to, with whoever you like, at whatever time you like. To build capital you need savings & you must invest those savings wisely.

When it comes to investing you can invest your money in the stock market, bonds, apartments, lands, personal businesses, etc. Before investing in any asset category you need to build your knowledge first. That is why investing yourself first is very important. You can do all these things just by using the knowledge that wasn’t taught in the school or university system. You have to take that knowledge from books or short-term courses.

3. Avoid Bad Debt

What do we mean by bad debt? First, we need to understand why we take loans. We take loans to buy an apartment for living, we take loans to buy a vehicle to drive, we take loans to get into higher education, we take loans to start a business, etc. The important thing about debt is once we buy something using debt/loans, each thing needs to generate some money for us. That kind of dent we call good debt & the debt that doesn’t generate money but spend our money we call bad debt. Always remember to avoid bad debt.