The Goldman Sachs

Goldman Sachs is the 7th largest bank in the USA. Goldman Sachs is an investment bank & financial services company founded in 1869 by Marcus Goldman. Over the past 155 years, Goldman Sachs has been offering different services. Goldman Sachs manages $538.13 billion in assets under their management across 10 million customers.

Investment Banking

- Advisory for mergers, acquisitions & restructuring

- Securities underwriting

- Prime Brokerage

Financial Services

- Asset, wealth & investment management

Share Performance

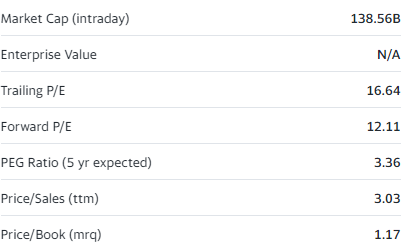

As you can see the Goldman Sachs stock (GS) currently trades under $432 a share with a total market cap of $140 billion. Last year’s Earnings Per Share was $25.65 & the PE ratio sits at double digits which 16.86. The company is paying a nice dividend to its shares which are worth $11 per share & with the current market price dividend yield is around 3%.

This is a well-established bank bringing a nice return to its shareholders. The bank got a high book value compared to its price.

The biggest risk of owning this stock is that Goldman Sachs has a high debt-to-equity ratio of 3. The net profit margin of the company is 20.15% & Return on Equity is 8%.