Identify Your Investment Purpose

- First, you need to understand why you invest your money. Do you want to build enough capital to retire comfortably? Do you need to make a lot of money within a short time? Do you need to build a portfolio for your children? Do you need an extra income source?

- Without knowing the real motive behind your investment it is too difficult to find the right investment strategy. Let’s say you want a stock portfolio to retire comfortably. So, you have to focus on buying high dividend-paying stocks. These stocks should pay consistent dividends for the last decade or so & it is far better to have a growth in dividend payout.

- Let’s say you want to make some big money within a short period. Then you have to buy high-growth stocks. You have to find & collect 10,20,30 baggers in your portfolio. Let’s say you want to build a stock portfolio for your children. Then you have to buy great companies at a very discount. You have to buy the stocks under their intrinsic value.

- If you are passionate about investing, if you really enjoy the process of investing & over the next 20,30 years you are going to invest in the stock market consistently then you can buy great companies with fair prices. It will take your energy, time & money. So, you have to be patient & wait right to time find such great company.

Never Lose Money

- As Warren Buffet says,

“The first rule of an investment is don’t lose money & the second rule of an investment is don’t forget the first rule.”

Warren Buffett

- No matter how much you invest in the stock, this is what you earn by sacrificing your time, and energy. This is hard-earned money. You cannot lose your wealth by just picking some guru’s stock tips. First, you have to understand the game of investing. You cannot view stock as a symbol.

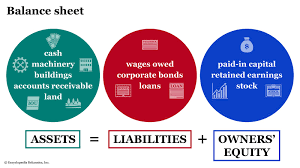

- A stock is not just a ticket symbol. There is a company behind every stock. The performance of the company is affected by the performance of the stock. So, you have to understand the business behind stock well. You need to understand,

How does this business make money?

How much assets & debt do they have in their balance sheet?

Who runs the company? Is the management team honest with customers, and shareholders?

Does the business pay dividends?

- You have to use some basic financial ratios to understand the fundamental value of the stock. After once you understand the business you have to find the intrinsic value of the company. There is no exact mathematical formula to calculate the intrinsic value. You can Warren Buffett’s speeches on YouTube & get some idea about how to value a business in each category.

- Once you identified the intrinsic value of the company you can buy the stock under its value. You must pay a bargain price to buy the stock. That is how you make & build capital in the stock investment.

Be patience

- No matter how good you are as a security analyst there is always a chance to wrong with your analysis. Sometimes you have to face instant economic, and social crises. You cannot predict those events.

- No one predicted the Corona pandemic in 2020. No one. So, you have to be patient in those scenarios & look at what will happen. You need to keep an emergency fund to support your expenses for the next 12 months or so. After such a pandemic, there is growth in the unemployment rate, hyperinflation situation, social unrest & curfews. You have to prepare for each event.