Value Investing vs Growth Investing

- warren Buffett, known as one of the greatest value investors of all time once said “Price is what you pay, value is what you get”.

- As he mentioned the stock price is the price that we pay. Value means that the intrinsic value of the business, with the time stock price, will reach to intrinsic value of the business.

- In this period investors have mislead with growth investing & value investing. Most investors think value investing is dead.

- Growth investing is the best & quickest way to become rich from the stock market. But this mentality is wrong. Any intelligent investing is value investing.

- It doesn’t matter whether you buying high-growth companies, it doesn’t matter you buying low PE stocks, it doesn’t matter whether you buy businesses under book value. Any type of intelligent investing is value investing.

- If a company is growing, all that means is that you’ve got more coupons in the future.

- You’re better off having a high return on equity & high growth in general. Growth & value will join at the hip.

Benjamin Graham

- Benjamin Graham is the father of value investing. He is also the mentor of Warren Buffett. In Graham’s book ‘The Intelligent Investor’ he has mentioned the difference between investing & speculation.

“ An investment operation is one which, upon thorough analysis, promises safety of principal & an adequate return. Operations not meeting these requirements are speculative. “

Benjamin Graham

- As Graham mentioned, investing is a deep analysis of the businesses to identify the intrinsic value & pay less price than the intrinsic value. All you need is to identify the intrinsic value & pay less.

How to Calculate the Intrinsic Value?

- Is there any equation to calculate or identify the intrinsic value of a business? No, there is no exact equation or formula to calculate intrinsic value.

- Identifying intrinsic value depends on the business. The metric to use to identify value is different from industry to industry, different from company to company.

- Each & every business runs its operations on a few variables. To identify those variables you have to think like the business owner. The business owner of the company never looks at the spreadsheet & makes decisions about the business. He always focuses on those 2 – 3 variables which make money for the business. We can start from here to identify value.

As an example let’s say you are an owner of a grocery store in your area. How do you make money from your grocery shop?

You have to give a friendly service to customers to attract them, to keep them. You have to open the store till midnight. You have to open the store for 7 days a week. You have to buy groceries for low prices from local suppliers. These are some key variables you look at.

When it comes to public companies the formula is the same. All you need to identify what are these key ingredients to make money.

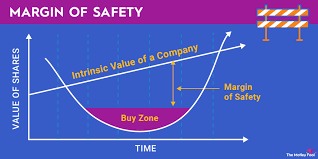

Margin of safety

- Once you identified the intrinsic value, you need to buy the business or stock less than the value. The gap between value & price is what we call the Margin of safety. In Graham’s book ‘ The Intelligent Investor- chapter 20 he discussed about this idea deeply.

“ No matter how careful you are, the one risk no investor can ever eliminate is the risk of being wrong. Only by insisting on what Graham called the “margin of safety”, never overpaying, no matter how exciting an investment seems to be, can you minimize your odds of error.

The Intelligent Investor

Pingback: How To Use Warren Buffett’s 5/25 Rule To Success Your Life - financialcloning.com

Pingback: A Deep Look Into Bill & Melinda Gates Foundation Portfolio - financialcloning.com