Mohnish Pabrai known as the modern Warren Buffett manages a fund called Pabari Fund worth over 900 million dollars. As the last 13f filing declares he is heaving buying coal companies & the only stock category in his fund is these energy, coal mining companies.

Why Mohnish Pabrai is so focused on these companies? When everyone is moving to clean energy why Mohnish is heavily invested in these stocks? Let’s dig into his portfolio.

Last quarter in 2023 he increased his Arch Resources Inc. share position by 200%.

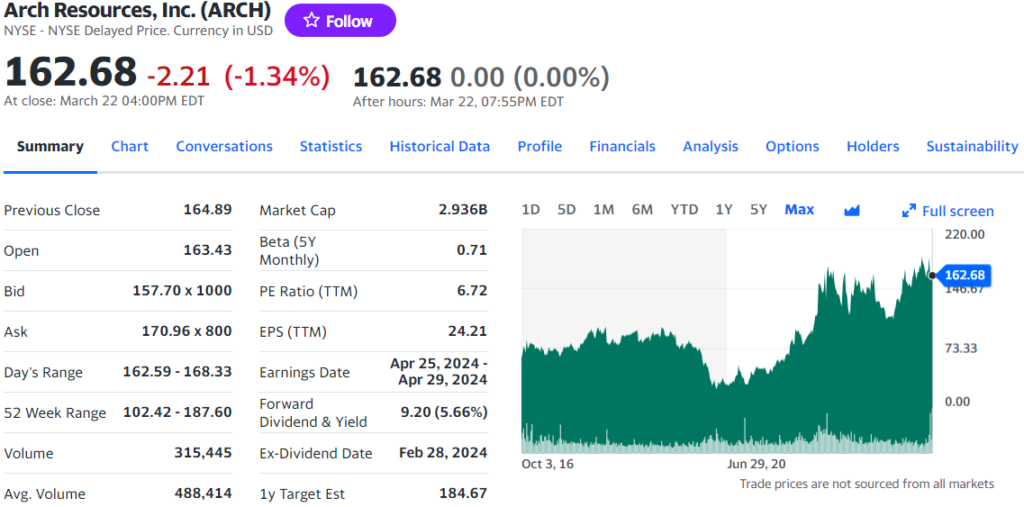

Arch Resources Inc. – ARCH

- ARC Resources Ltd. Is a Canadian energy company that has been operating since 1996. ARC’s operations include the exploration, development & production of conventional oil & natural gas reserves. The operations expand in Western Canada mainly.

- ARCH shares currently trade at around $160. The PE ratio is around 6.7 & they have declared a $9.20 dividend in 2023. It’s a 5.66% dividend yield & very healthy dividend. Since 2020 they have increased their Revenue from 1.4 billion dollars to 3.1 billion dollars. They have increased their net profit from an almost huge loss of 344 million dollars to a profit figure of 464 million dollars this year. This is a huge growth for a company like this. Due to COVID, they showed a negative figure in their profit. But they managed to make a profit a year after that.

- Mohnish Pabari is buying ARCH shares from quarter 3 in 2023. In his USA stock holdings, he has only 4 stocks worth 250 million dollars & his ARCH share is worth around 40 million dollars.

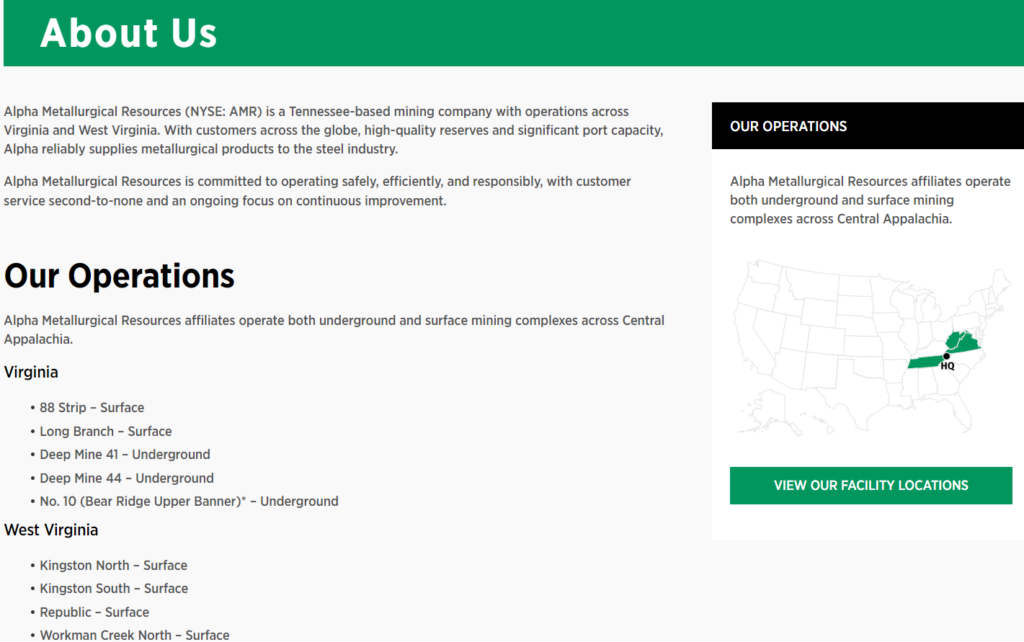

Alpha Metallurgical Resources Inc. – AMR

- Alpha Metallurgical Resources is a Tennessee-based mining company with operations across Virginia & West Virginia. AMR shares currently trade at $325 & the PE ratio is 6.31 & they pay a $2 dividend per share.

Pingback: 3 Tactics to Achieve High Returns with Your Investment Portfolio - financialcloning.com

Pingback: A Deep Look Into Guy Spier’s Portfolio: Top 5 Holdings - financialcloning.com

Pingback: How To Behave In A Stock Market Crash - financialcloning.com