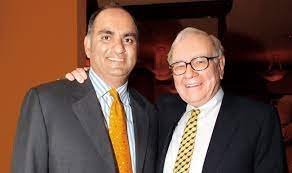

Mohnish Pabrai, often known as the Indian Warren Buffett has achieved an annual average return of 25.7% over the past 18 years. The way he invests according to Forbes is he has no interest in a company that looks 19% undervalued. He is angling to make 5 times his money in a few years. If he doesn’t think the opportunity is blindingly obvious he passes.

Now this strategy works between 2000 & 2018 the assets that he’s invested have gone up over 900% resulting in him managing more than $600 million. So how did he do it? How did he dominate most investors who were struggling to get a 10% annual return?

3 Investing Rules

Rule 1: Be a Shameless Cloner

“The simplest way to find bargains is to be a cloner. I am what you would call a shameless cloner & then in the U.S., we have 13f filings where every quarter people have to file what they own. Just figure out who the smart people are, look at what they are buying, reverse engineer them, you don’t need an analyst/ it’s fun.”

Mohnish Pabrai

- This is a very smart & obvious strategy from a niche but so few people do this. Because every quarter most well-known investors are legally required to show what stocks they’ve invested in through a 13f filing.

- So, Mohnish’s strategy is to find an investor that has got high returns in the past & one that he trusts & then simply copy their investments.

- It’s a straightforward thing to do. Just type on the Google data Roma. Go on to the super investors category. Here you have some of the highest achieving investors who legally have to disclose what they own. You can click on one great investor like Warren Buffett & you can see what stocks he bought recently.

- If you like Warren Buffett as an investor take what he’s bought, analyze it yourself & then decide if it’s worth investing in.

Rule 2: Buy Stocks with a Moat

“It’s a moat & they’d break it down to one word. A business can have some type of enduring competitive advantage that allows it to earn better than an average rate of return over an extended period. Some businesses have narrow moats, some have broad moats, and some have moats that are deep but get filled up pretty quickly. So, what you want is a business with a deep moat with lots of pirana in it & that’s getting deeper by the day. “

Mohnish Pabrai

- In investing moat is used as an analogy for a business that has a strong competitive edge. Even if more competitors come & try & take a piece of their business that moat is so strong. It has so many piranhas in it that it’s too hard for competitors to attack what they’ve created.

- For example Coca-Cola, it’s not easy for a competitor to come in & replicate Coca-Cola. Because their user base is very strong.

Rule 3: You Make Money by Waiting

“I think the biggest edge would be attitude. Charlie Munger likes to say that you don’t make money when you buy stocks & you don’t make money when you sell stocks, you make money by waiting. The biggest advantage a value investor has is not IQ. It’s patience & waiting. Waiting for the right pitch & waiting for many years for the right pitch.”

Mohnish Pabrai

Pingback: Mohnish Pabrai: How To Earn A 25% Return Per Year - financialcloning.com

Pingback: What Is Mohnish Pabrai Buying When Market Is All-Time-High - financialcloning.com