Unfortunately, the sad reality is that most investors lose money in a stock market crash. However, if you have the right mindset in the right investing style instead of losing money you can make a lot of money. Let me show you that Peter Lynch thinks the same way.

Peter Lynch is a legendary fund manager who has achieved an annual average return of 29.2%.

3 Points on What to Do

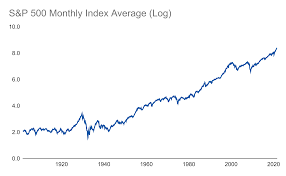

1. Over the Long-Term Stock Will Go Up

- You have to remember that a stock is a part of a business & businesses the end of the day their main goal is to make money. Do you think in 3,5 or 10 years, businesses will be making more or less money? Of course, they will be making more money.

- As Peter Lynch said, corporate profits grow around 8% every year. This means due to compounding they double their earning around every 9 years. Therefore stock market ought to double around every 9 years.

2. Buy Stocks When They’re Low

- Over the long term, things are going to go up. So, when would you want to buy it, when is the best time, well at the bottom of course? A market crash is good for us investors as Peter Lynch says ‘I love volatility’.

3. Buy Good Quality Businesses

- Let’s take an example like Cocacola, over a long period it will go up as it is a great business.

- No one is going to be able to predict what happens in the stock markets over the short term. It’s just not possible. They might get it right once or twice if they are lucky but they can’t do it regularly or they’d be filthy rich.

- But we do know that over the long term, the stock market will go up & that’s why it’s so important. When stocks are down & cheap we start investing for the long term. But as Lynch says these must be in companies that we understand.

- We must put the time & effort into learning the balance sheet, income statement, looking at the profits comparing at to price, all the basics. If you don’t go through them odds are you are going to come out on the bottom.

- The other thing that Peter Lynch recommended was that you need to know history. So, if you go back 75 years or so it does give us a good picture of how the market works.

“When an individual with cash meets an experienced individual, that individual with experience ends up with cash & that individual with cash leaves with experience.”

Warren Buffett

Pingback: How Michael Burry Is Predicting a Stock Market Crash? - financialcloning.com