Why should we invest in the stock market?

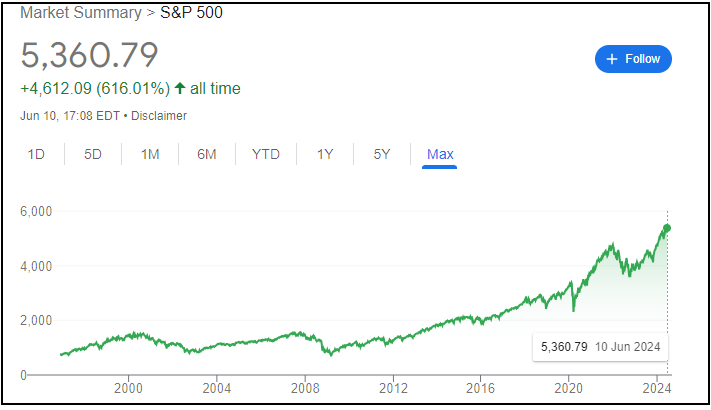

Investing in the stock market gives the potential for higher investment returns over the long term. History has proved that the stock market has given higher returns than other asset classes like bonds, real estate, or commodities.

The S&P 500 has provided an average annual return of around 10%. When companies show profit growth, shareholders benefit through rising stock prices & dividends.

One of the key advantages of investing in the stock market is the ability to diversify our investment portfolio. We can invest in different industries, and different companies & all around the world.

Another major benefit of investing in the stock market is, that it protects against inflation. With such an inflationary environment companies can often pass increased costs to consumers, maintaining their profit margins.

How to select a good stock?

1. Know What You Own

The main thing about selecting a stock is that you need to understand the business operation of the company. How does the company make money? The products & services they sell? How much money does the company make? How many assets & liabilities does the company have? Does the company pay a dividend? Who is the management team? Who owns the majority shares of the company?

You need to read up on the company’s history & its leadership team. Check if the company has a strong & consistent track record of growth & profitability.

The best way to select a stock is to identify what you consume every day in your life. What kind of products & services do you use & then you can start analyzing each product or service providing business.

2. Buy Below the Intrinsic Value

After you do your ground work you have to assess the value of the company. The price is what you pay, the value is what you get. There are different ways to identify the intrinsic value of the company.

The most common way to do a business valuation is free cash flow basis analysis. The problem with such valuation is that you have to use basic assumptions. You have to predict the profit growth for the next decade or so. You have to assume what the growth of capital expenditure will be. A lot of assumptions.

Once you identify the value of the company you need to buy the stock below the intrinsic value. That is what we are calling value investing.

3. Buy & Hold

The person who makes money, and grows wealth holds their stock long period. Once you buy a good stock you need to keep it for a long period. Some investors’ favorite holding period is forever. You have to let compounding interest do its job. Never interrupt the compounding. Once you identify a big opportunity there is no issue with investing big. But always keep in mind to hold the great companies as long as they perform well.