Why should you invest your money?

No matter which age you are, what career you are doing, how much money you are making we should all need to invest our money. As humans, we all make some money to live. At the end of the month, most of us get a paycheck from our job or our monthly or annual profit from our business.

Once you get the paycheck or profit you spend that money to buy groceries, pay rent, pay student or housing, or vehicle loans. What is the last time you spend some money on yourself?

Once you get old enough you will not be able to work, then you will not get your monthly paycheck. But still, you have to eat, you have to pay the bills, you have to spend for your kids, still, you have to travel, and most of the time you will have to spend money on your health.

So, from where will you find this money? That is why you need to have enough savings & investments to cover your monthly, and annual expenses. Investing your hard-earned cash is the best way to invest in yourself.

You have multiple choices when it comes to investing. You can invest your money in stocks, bonds, real estate, cryptocurrency, personal business, and knowledge I believe investing in your knowledge is the best investment among these investments.

What is the best investment you can make?

Before you start investing, you have to learn and study about your investment class.

I think most of you would do deep analysis when it comes to buying a vehicle. You will check what price is this car selling for, does the engine of this car works well, and how much mileage can go with 1-liter petrol. You will compare this car with other cars. Lots of work.

But when it comes to investing people just go & buy what their social media friends tell, what tv-gurus said. Zero groundwork. How could you think that without any work you will succeed in investing? You don’t know what you own. You don’t know what is the value of this asset. Sometimes you would have paid a high price for that.

Maybe you will be lucky to make a couple of thousands in luck. But over the long run, you will lose. Why do you destroy your hard-earned money?

So, my recommendation is no matter how hurry to invest your money you should need to learn and study about your investment deeply. Otherwise, you will lose everything.

Why stocks?

As I mentioned earlier you have many asset classes to invest in. Let’s dig into each asset class one by one.

Bonds

- Over the past five decades, the average rate of return for the 10-year U.S. treasury bonds is around 5%.

- Let’s say at age 20 in 1974 you invest $1,000 in treasury bonds giving you a 5% return & let’s see what would happen to your initial investment after 50 years in 2024 at the age of 70.

- $1,000 * 1.05^50 = $11,467.40

- Your initial $1,000 has become $11,467.40 after 50 years. Not a big deal, your initial investment has 11 times the return.

Gold

- The average annual rate of return for gold over the last 50 years is approximately 8%.

- Let’s say you invested $1,000 in gold in 1974 at the age of 20 & see what would happen today.

- $1,000 * 1.08^50 = $46,901.61

- Your initial $1,000 investment has become $46,901.61. 47 times return for the last 5 decades.

Stocks

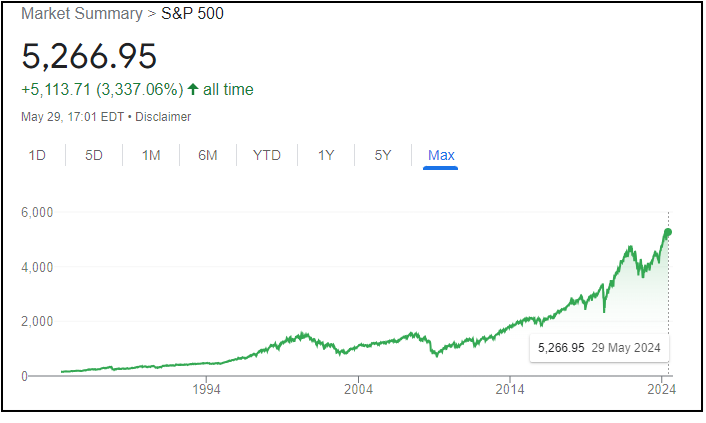

- The average annual rate of return for the S&P 500 over the last 50 years is approximately 11.4%.

- Let’s say you have invested $1,000 before 50 years & let’s see what happened to your investment.

- $1,000 * 1.114^50 = $220,932.47

- I think you will see the difference. Let me take these numbers in one place then you will get an aha moment.

| Asset Class | Initial Investment | Period | Annual Rate of Return | Annual Rate of Return |

| Bonds | $1,000 | 50 years | 5% | $11,467.40 |

| Gold | $1,000 | 50 years | 8% | $46,901.61 |

| Stocks | $1,000 | 50 years | 11.4% | $220,932.47 |

Summary

This is a massive difference in your investment. Without doing any hard work your initial investment of $1,000 has turned into a massive $221k investment. This is not rocket science. This is just the nature of the compound interest effect.

Even if you are not interested in picking individual stocks you still can be a wealthy guy just by investing in an index like the S&P 500.

The key point here is to start investing as soon as earlier & not interrupt the compound engine. I do not recommend anyone put all their money into stocks gold or bonds.

I tell guys that first you must learn, then save some portion of your monthly paycheck & invest consistently in stocks or bonds or gold. Having a diversified portfolio is good for your mental freedom.

Personally, as a young investor, I like to keep my 100% investment in stocks. But your story may be different. No matter how hard or easy your life you need to invest money for your benefit in the future.

Pingback: How to Grow Your Wealth: Stock Market Investing - financialcloning.com