What is Meta?

Meta is a technology conglomerate formerly known as Facebook. The company owns Facebook, Instagram, WhatsApp & Threads.

Meta is the 7th largest company in the world by market cap & Meta has dominated social media all around the world.

Meta has engaged in virtual reality technology in the last couple of years & their primary goal is to bring their all social media platforms into a virtual environment called Metaverse.

Who founded Facebook?

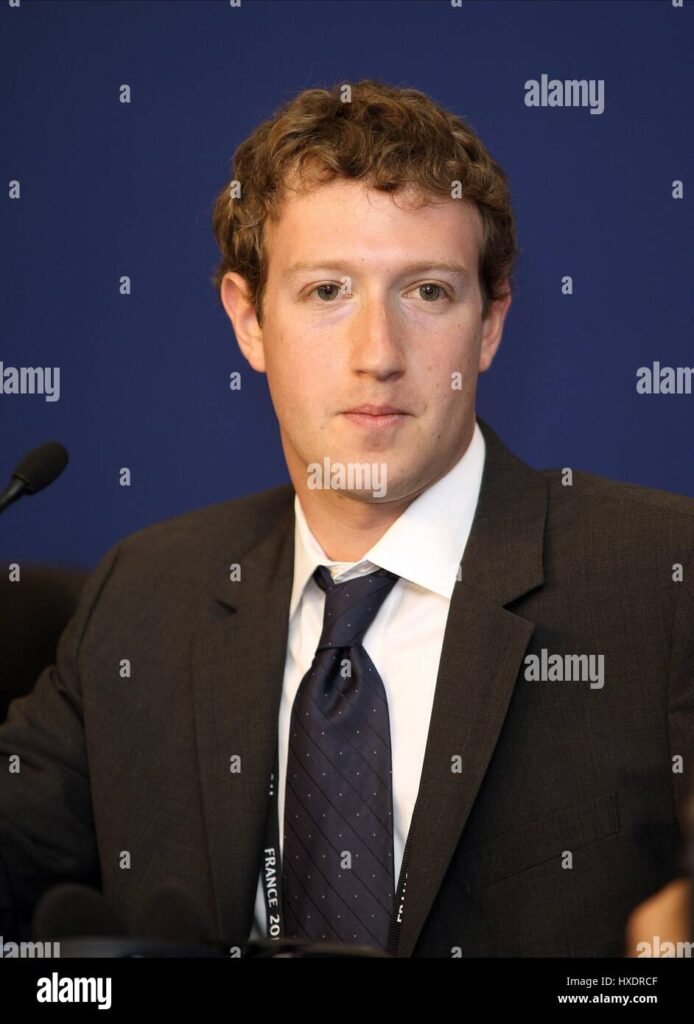

In 2004 Mark Zuckerberg with four other Harvard College roommates founded Facebook, now known as Meta. Mark Zuckerberg is the 4th richest person in the world now & at age 23 he became a billionaire.

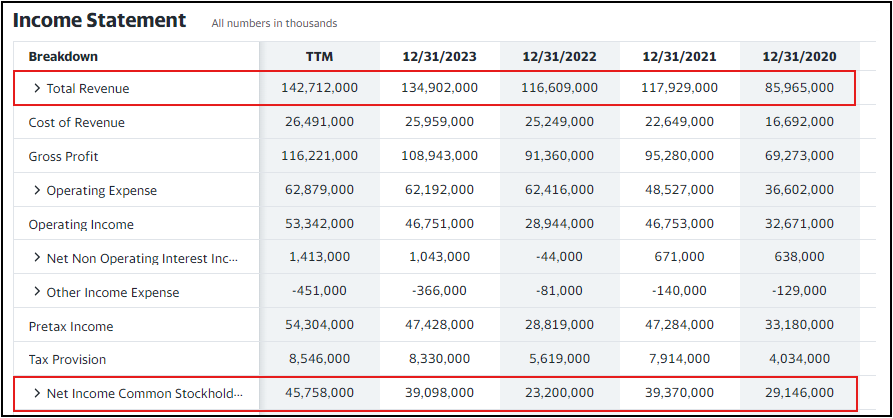

How much money does the Meta company make?

For FY2023 the Meta has made $134.9 billion in revenue & $39 billion in net profit. The revenue of the company has increased from $85.9 billion in 2020 to $134.9 billion in 2023.

How many assets does the company have?

The total assets of the company are $185.7 billion for the date of 31st December of 2023 & shareholders’ equity figure is $153 billion.

The debt-to-equity ratio is 50% which means the Meta company’s total debt equals half of its total equity. Having such a low ratio allows the company to perform well even in bad economic situations.

How much is a Meta stock?

A Meta share is currently trading for a price of $478 per share & the market cap of the company is $1.213 trillion right now.

The last 12 months’ earnings are $17.36 per share which gives the PE of 27.55. The company has paid a $2 dividend per share & dividend yield of 0.42%.

Who owns the Meta?

Vanguard Group is the largest institutional shareholder of the company & they own 8.54% of the company. Blackrock is the 2nd largest institutional shareholder & they own 7.25%.

The largest individual shareholder of Meta (Facebook) is Mark Zuckerberg & he owns 13.6% of the company.

Mark Elliot Zuckerberg, who co-founded Facebook lately known as Meta is the chairman & chief executive officer of the company.