What is dividend investing?

Earning an extra $1,000 a month by doing nothing, can you imagine how cool it is? It is decent money & what’s great about this money is you don’t have to do any extra work for it. That $1,000 comes to your bank account every month.

That is the beauty of dividend investing & that income we call passive income. As Warren Buffett mentioned if we don’t find a way to make money while we sleep, we have to work until we die. So, dividend investing, getting $1,000 dividend income a month by doing nothing is a good start.

How to get started?

All you have to do is identify the dividend strategy you will use, pick up the right companies & get started by investing some money. The thing about getting started is that a lot of people look at this milestone of $1,000 a month & think I’ll never get there, that is a very hard goal to achieve.

Compound Interest

But the problem with these people is that they don’t know about the 8th wonder of the world, compound interest. You don’t need to start by getting $1,000 a month.

You can start with a small milestone. In the beginning, you can start by getting $100 a month. Then you can reinvest your monthly passive income to buy more shares. You can put more money from your paycheck to buy stocks. After a while, you will build a very strong stock portfolio that pays huge dividends.

When time passes & you invest consistently you can turn that $100 into $200, $300, $500 & after a while $1,000 is not a magic number anymore.

Financial Freedom

Once you build a strong, stable stock portfolio that pays enough dividend income to cover your monthly/annual expenses you can quit your job & spend that free time to pursue your dreams.

You can start a full-time online business in that free time & you can grow it, you can spend more time with your family & you can enjoy your free time by doing the things you love most.

How do you select a good dividend stock?

Dividend Yield & Dividend Payout

Before selecting a dividend-paying stock you have to know the dividend yield & dividend payout of the company.

| Dividend Yield = (Dividend per Share / Current Market Price) * 100% |

Dividend yield indicates the annual income earned by an investor to the price of the investment. It is calculated by dividing the annual dividend per share by the current market price per share & we need to get this as a percentage.

| Dividend Payout = (Dividend per Share / Earnings per Share) * 100% |

Dividend payout gives how much portion of a company’s earnings that is distributed to its shareholders in the form of dividends. It is calculated by dividing the dividend per share by the company’s earnings per share & this number also needs to be as a percentage.

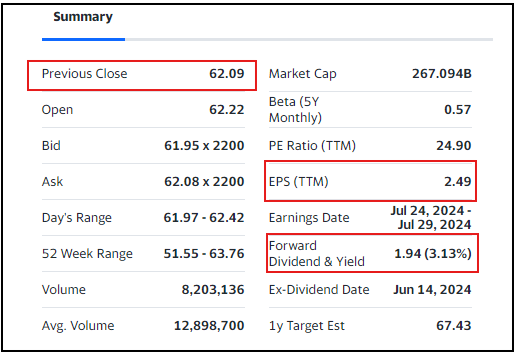

Coca-Cola stock: KO

Let’s look at a real-world example of the Coca-Cola company.

The company’s forward dividend per share is $1.94. It means the company is expecting to pay $1.94 per share as dividends in the coming year. The Coca-Cola (KO) share is currently trading for $62 per share. If we divide $1.94 by $62 we get the dividend yield of 3.13%.

For FY 2023 the company has earned $2.48 per share & $1.94 divided by $2.48 we get the dividend payout of 78%. It means Coca-Cola company is paying 78% of its earnings to its shareholders back & only 22% of the earnings remain in the company to expand its business operations.

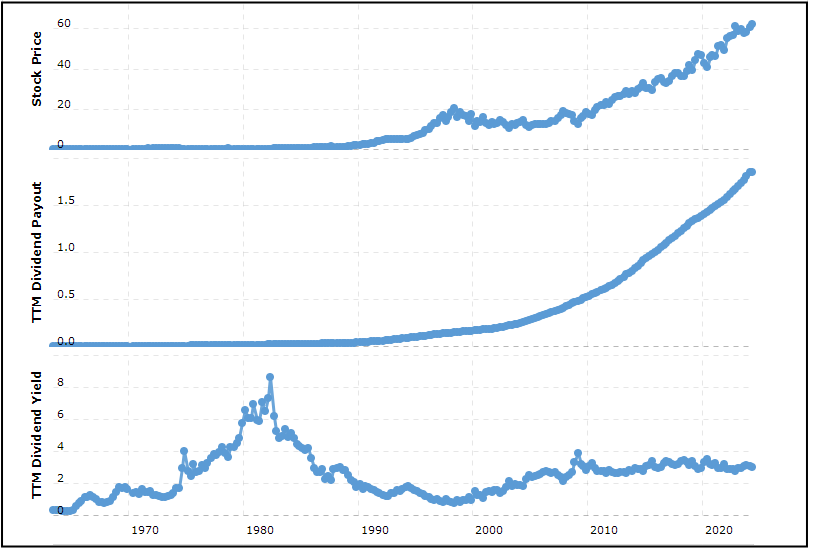

Dividend History

The other most important thing we need to consider is, has this company paid consistent dividends to its shareholders for the last decade or so.

When we look at the dividend history of Coca-Cola company it has paid consistent dividends for the last three decades & one more interesting fact is that the dividend payout has increased year after year. It is another positive sign when it comes to dividend investing.

What are the other factors to consider?

- Another factor we need to identify is the future earnings growth of the company. If the company has no earning growth, in the future it will not be able to pay dividends. So, we have to identify their business model & consider whether are they capable of making enough cash flow to pay consistent dividends to their shareholders.

- Another fact we need to consider is the company’s financial position. Is this a company with high leverage or not? Do they have enough cash balance to survive in an economic recession? Are they growing their book value over time? No matter how good the dividend yield of the stock is, if they have no financial strength to survive in a bad economic condition the company will be wiped out.