Stock 1: Walmart (WMT)

How does this company operate?

Walmart is known as a discount retailer, they operate in 24 countries with 10,586 stores. Walmart is the world’s largest company by revenue & Walmart showed that its FT2023 total revenue was $648 billion. Walmart is also the largest employer with 2.2 million employees & 65% of Walmart’s sales come from the USA operations.

Why does this stock do well in a recession?

When it comes to economic recession Walmart is a good performer. Even during a pandemic situation people still need to eat. They have to eat cheaply. So, Walmart is a good place to spend their money & have the food they need.

Financial & stock performance

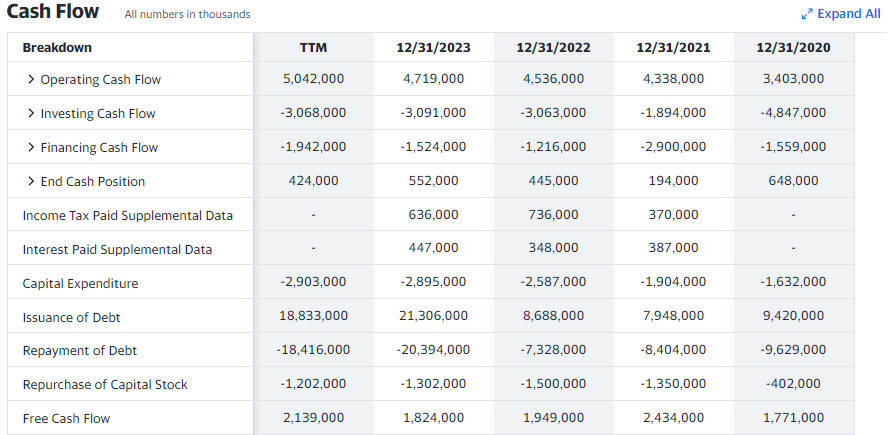

Over the past couple of years, Walmart has increased its revenue from $559 billion to $648 billion & net income from $13.5 billion to $15.5 billion. Walmart has $252.4 billion in total assets under its management & $90.5 billion of equity. The company owed $161.8 billion to its creditors. When it comes to Debt to Equity it is almost 178%, Return on Equity is 17%, and Return on Assets is 6.1%.

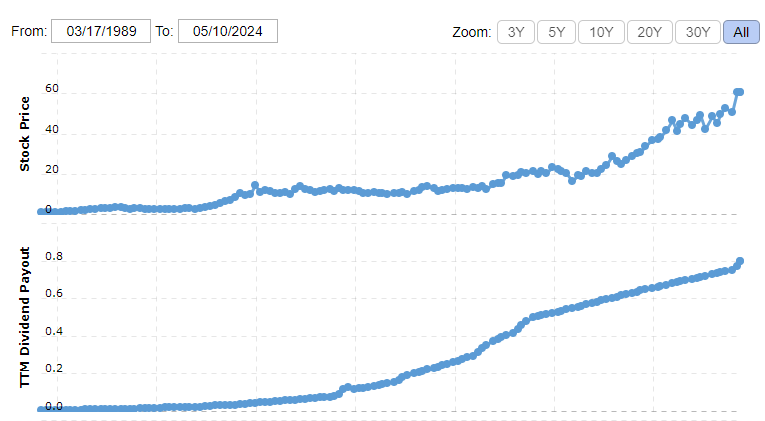

The WMT stock is selling for the price of $60, and earnings are $1.91 per share giving the PE of 32, the PE ratio is a little high. The dividend yield is 1.37%. As you can see divided history was consistent over the past 35 years & they have increased the dividend payout each & every year.

Stock 2: McDonald’s (MCD)

How does this company operate?

McDonald’s is a fast food chain founded in 1940 in the USA & today McDonald’s has grown into over 100 countries with over 40,000 outlets. There is no one in the world not knowing about McDonald’s & without any age restriction everyone loves to eat McDonald’s products. McDonald’s is the most popular fast-food chain in the world.

Why does this stock do well in a recession?

People go to McDonald’s outlets to eat cheaply. Even one of the greatest value investor of all time Warren Buffett also get his daily meals from McDonald’s. He is a big fan of McDonald’s. During an economic recession, why does McDonald’s perform well? People need to eat no matter what the economic or social situation is. During an economic crash, people will cut off their extra expenditures such as haircuts, taking vacations, going to 5-star restaurants, and luxurious items. They will cut down on expensive foods & eat cheap foods from McDonald’s.

Financial & stock performance

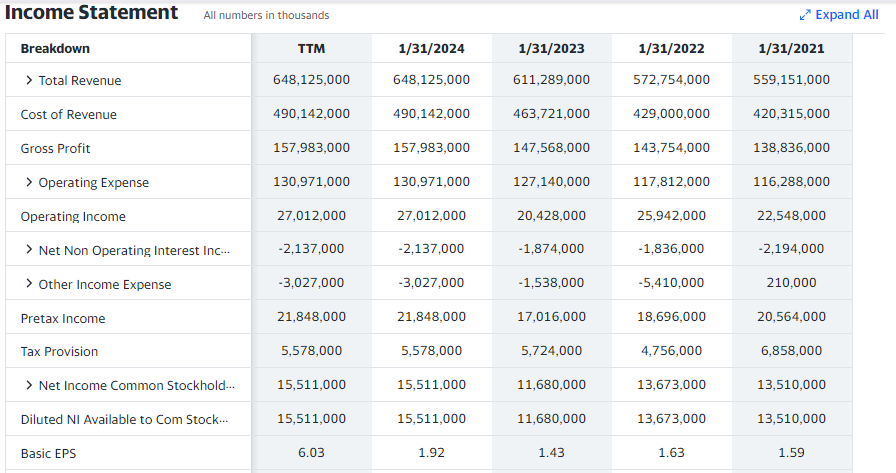

McDonald’s is a very cash-rich company. To the date of 31st December 2023, the company has $2.583 billion in cash. Although the company is in some bad situations still it has the potential to recover with such a huge cash pile. For the FY2023 the company has recorded $25.5 billion in revenue & $8.5 billion in net profit. The net profit margin is 33.3%.

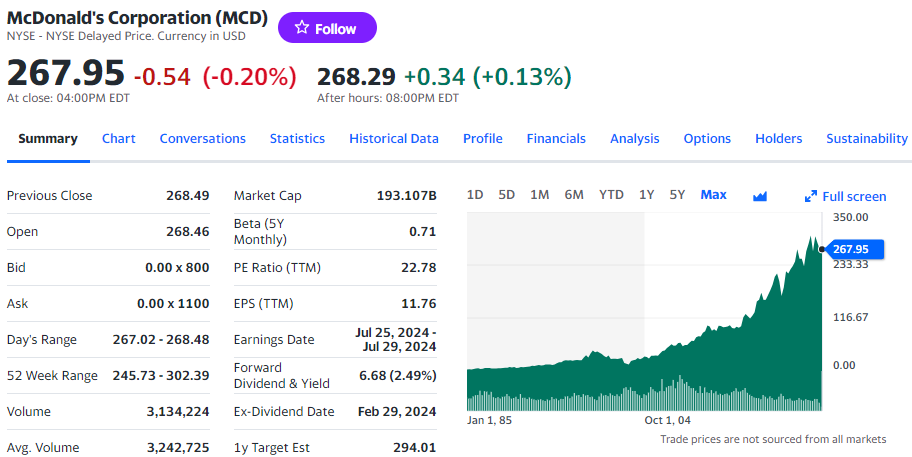

The MCD stock currently trades at $270. Earnings are $11.76 which gives the PE of 22.78. the dividend yield is 2.5% & over the past 35 years, they have increased their dividend payout year after year.

Stock 3: Waste Management (WM)

How does this company operate?

Waste Management is a company operating in North America. This is a company Bill Gates has added to his portfolio. The company is mainly dealing with waste & they collect waste & recycle it. Waste Management serves 20 million customers in North America. The company operates under 16 waste-to-energy plans, 104 recycling plants & 111 landfill gas projects.

Why does this stock do well in a recession?

Even in a recession, people need to throw their waste. Houses and factories still produce waste in a recession. If the company does its job correctly it will earn money even in a recession.

Financial & stock performance

The company recorded $20.4 billion in revenue for FY2023 & earnings are $2.3 billion. The net operating cash flow is $4.7 billion & capital expenditure is $2.9 billion which gives the free cash flow of $1.8 billion.

WM stock currently trades at $210 per share & earnings are $6.10 with a PE of 34.51 somewhat higher number. The dividend yield is 1.43%.