Warren Buffett known as one of the greatest investors of all time has very different ideas about Bitcoin. Unlike young investors Chamath Palihapitiya, and Cathie Wood, Buffett is not a big fan of Bitcoin. In many cases, he has criticized Bitcoin.

“If you told me you owned all of the Bitcoin in the world & you offered it to me for $25, I wouldn’t take it. Because what would I do with it.”

Warren Buffett

- Warren Buffett’s partner & mentor Charlie Munger also hates Bitcoin.

“I have a slightly different way of looking at it. In my life, I try to avoid things that are stupid & evil & make me look bad in comparison with somebody else. Bitcoin does all three.”

Charlie Munger

- They first started talking about Bitcoin in early 2018. Since then Bitcoin has increased almost 400%. So how can Bitcoin be so bad if it is doing well? Why are legends in the investment world like Warren & Charlie not interested in Bitcoin?

“Bitcoin is the apex property of the human race. There is no property invented in the history of mankind that is better than Bitcoin. If you have a superior asset, it is going up forever. ”

Michael Saylor

“That is going to scale from a little more than a trillion dollars today to $25 trillion in 2030.”

Cathie Wood

“I can say with certainty that it will come to a bad ending.“

Warren Buffett

“It is kind of a pure greater fool theory. I would short it if there was an easy way to do it.”

Bill Gates

“Bitcoin is worthless artificial gold. I think it is a scumble.”

Charlie Munger

Bitcoin is a scam?

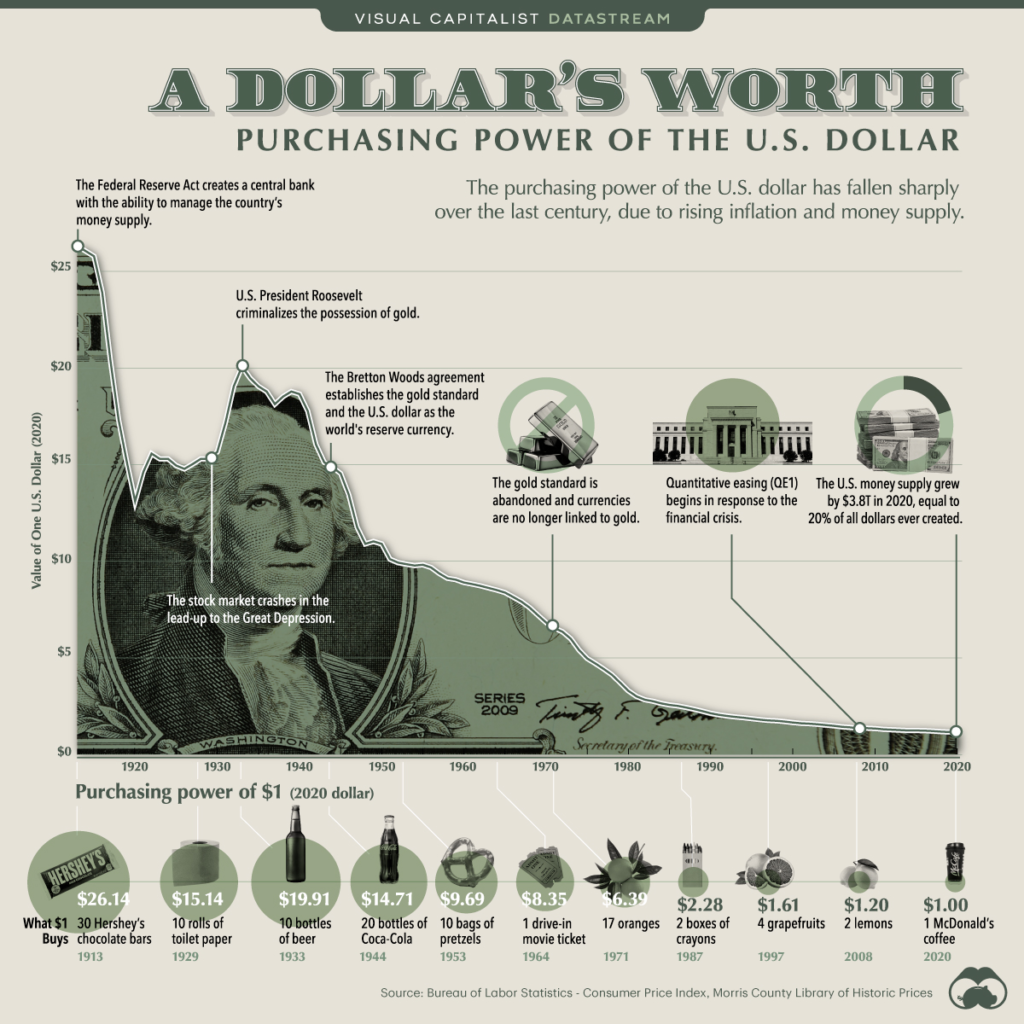

- The thing we know as traditional currency has huge problems today. Governments print more money day by day, inflation is rising, prices of goods are rising, the rate of lending is skyrocketing, day by the value of traditional currency value is decreasing & people are starting not to believe traditional fiat currencies.

- If you go back in history you will notice that this issue is not some modern-day problem.

“The dollar is losing 7% to 10% of its value a year for 100 years. That means over 100 years the dollar lost 99% of its value. My house in Miami Beach was purchased for $100,000 in 1930. I bought it for $14,000,000 in 2012. Today it is $50,000,000. From$100,000 to $50 million in less than 100 years. That is not the house getting more valuable. That is the currency getting less valuable.”

Michael Saylor

- The problem with this currency is that it is controlled by a central power.

- That is why as a solution of this Bitcoin has been introduced.

- It was designed in a way to solve all of the issues of modern traditional currencies.