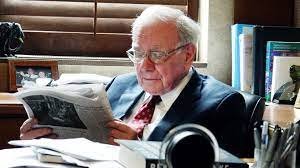

- Warren Buffett is the 5th richest man in the world with a net worth of $106 billion. If you go back to the end of 2007 his net worth was only $34 billion. How did Buffett make so much money so quickly? Warren Buffett tripled his net worth in such a short period.

The 2008 Crash Creating Opportunities

- In 2008 most of you probably already know it was the housing bubble crash. Banks were lending out too much money to people who could not afford to pay their mortgages back & eventually things collapsed on themselves. The housing bubble popped & with this so did the stock markets. The stock market lost over 50% of its value during that time.

- Warren Buffett, the world’s greatest investor was smart. He had been saving up cash for this exact moment. In & after the crash was his time to pounce. One of Buffett’s great deals made during this time was a $5 billion investment in Goldman Sachs. The bank was struggling big. They needed cash & Buffett so elegantly gave them the cash that they needed in exchange for the preferred stocks. 3 years later he redeemed the shares cashing in a $3.7 billion profit a 74% return in such a short period.

“Now is a great time to buy a slice of America’s future at a marked-down price”

Warren Buffett

During the 2009 period once stocks were selling for cheap prices, Buffett was buying. Buffett made some key investments in these companies.

Johnson & Johnson

- One of the great American healthcare companies. They sell a range of skincare, healthcare, medical device, and pharmaceutical products throughout the whole world. The stock has done tremendously well for Buffett. He was buying the share in the $50-60 range & nowadays it trades at $160. Giving him about 200% return. J&J also paid consistent dividends.

The Banking Stock

- As we mentioned earlier he bought Goldman Sachs during the crisis. He was also adding to his Wells Fargo & US Bancorp. positions these were one of the badly hurt sectors during their crash. The main stock Buffett was buying was Wells Fargo.

- He was buying Wells Fargo shares around the $12 to $30 range. The share currently trading around $58 per share. He made almost 100% return over the years & Well Fargo paid consistent dividends for shareholders.

“Banking is a good business if you don’t do dumb things on the asset side, I mean, basically”

“The banks we own earn between 12% & 16% or so on net tangible assets. That’s a good business, that’s a fantastic business against the long-term bond at 2%”

Warren Buffett

Walmart

- They have an array of discount stores & grocery stores throughout the USA. They generated $648 billion worth of revenue in 2023 alone. The GDP in Sweden in 2022 is $585 billion & Walmart’s turnover is larger than the whole of Sweden’s GDP. Buffett bought Walmart for around $20 & now it is trading at $60 per share, almost a 200% return over the past decade.

Pingback: How to Predict a Stock Market Crash: Warren Buffett - financialcloning.com