The very first thing you probably think of when it comes to Bill Gates is a nerdy businessman. You don’t necessarily think extremely smart investor. Yet he is both & he amassed a big fortune by creating Microsoft but he turned this big fortune into a massive fortune through extremely smart investing.

Ignore the Noise Focus on Buying Great Companies

“I think the philosophy that Warren Buffett is put forward that if you can find great companies & invest in them then the macroeconomics can go up & down & the basic value of what you’re holding on to there will be main team throughout that. I have a team of people who manage that for me. They’ve done a great job. As we were long-term oriented & don’t think that we understand the macroeconomics enough we’re making bets that are specific to that piece. My best business decisions have to do with picking people.”

Bill Gates

To Win Big You Sometimes Need to Take Big Risks

- This is a direct quote from Bill Gates. What he is trying to say is that sometimes if you’re overly conservative with your investing style, you are going to miss out on those high returns.

- Let’s take some examples. What are the companies that have done the best over the last decade? There’ve been highly innovative technology companies like Netflix, Amazon, Apple, etc. These companies have gone up more than 1000% over the last 10 years.

- A lot of people if you invested in the stocks back in the day will say ’ You’re taking a major risk’. Yes, that’s true. You’re taking a major risk but you know what else you’re taking on a massive opportunity. An opportunity to make extremely high profits of thousands of percentage points.

- If you apply this to investing don’t be afraid to invest early if you see tremendous upside.

Patience Is Key When Investing

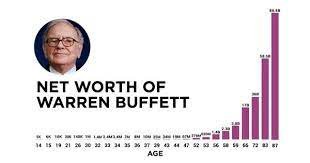

- The thing you need to realize about a lot of investments is that inevitably you’re going to see a lot of ups & downs. Doesn’t matter what type of investor you are you can’t handle the ups & downs of the stock market. If you can handle these ups & downs over the long time horizon you will make huge wealth. Warren Buffett made 99.7% of wealth after the age of 52. This is all due to patience & compound interest.

Pingback: How John D. Rockefeller Built His Trillion-Dollar Oil Business - financialcloning.com