Ray Dalio, is an investor who runs the largest hedge fund in the world called Bridgewater.

One of his specialties is looking at market cycles. Are markets poised to crash? Are they poised to go up? What are the patterns we can see?

Signs Of A Market Crash

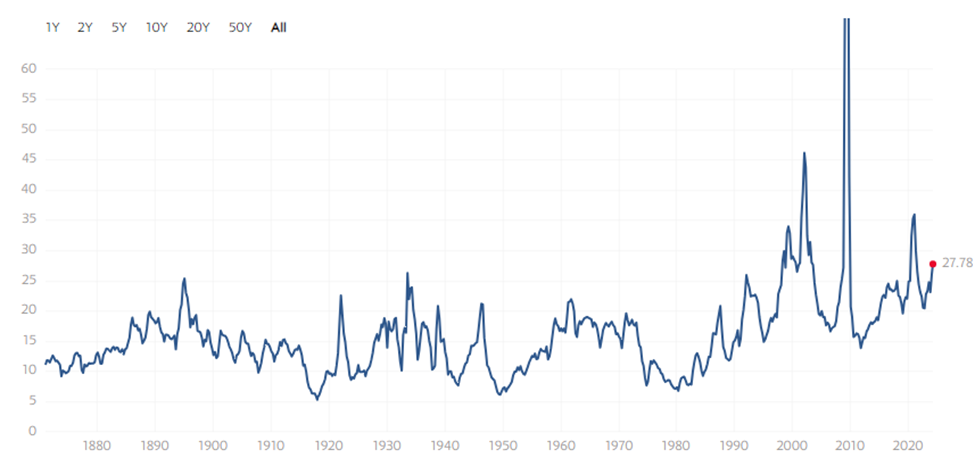

Prices are High Relative to Traditional Measures

- One of the easiest ways to do this is by looking at the PE ratio. If we look at the S&P 500 PE ratio we can see that it’s sitting at a high amount right now 27.78.

- This is much higher than the average that we see in 15 across time. Dalio makes a good point & says we have to compare to this to other asset classes. This way we have something to measure against.

Let’s do some basic calculations here.

The PE ratio (P/E) = 27.78 if we reverse it this implies Earning Yield of

E/P = 3.6%

So if there was no growth in the market we could get a 3.6% return. But we need to include growth. Right now business growth in the USA sits around 2.5%.

So, if we add the 2.5% growth onto the 3.6% earning yield we get.

Total Return = Earning Yield + Growth = 3.6% + 2.5% = 6.1%

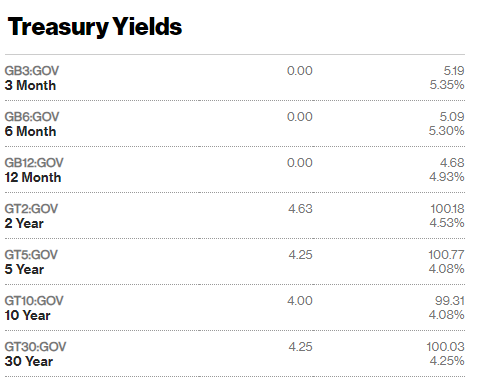

- If we take a look at the bond market bonds are currently yielding around 4%., which is 10 year treasury bond.

- If we compare the return we get in the stock market relative to the return that we get in the other main asset which is bonds, the stock market is not overly expensive.

Prices are Discounting Unsustainable Conditions

“unsustainable starts to be part of this picture of a bubble. Unsustainable means that by the nature of the buying whoever is doing the buying & how of that supply demand won’t be sustained & that produces a correction or price is going down.”

Ray Dalio

New Buyers Have Entered the Market

- Ones that generally don’t know too much about investing, have no experience & are simply investing because they see their friends are making money in the stock market.

- The example that Dalio gives is, let’s say you’re at a cocktail party for work & people come up to you & they start talking about their recent investments in the market & you ask them ‘Well have you ever invested before?’ they say, ‘no, not before this’ ‘did you buy the stock at a reasonable price?’ they say, ‘I don’t know how to calculate intrinsic value’ you ask, ‘do you know what a stock is?’ & they fumble around for an answer.

- You find out they’re simply investing because the stock market has been on a bull run & has made other people rich. When you have a lot of new investors entering the market with little understanding of it it’s a signal of a bubble.