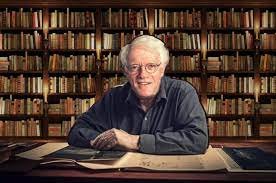

Peter Lynch is the man who achieved a 29% average return per year over his investing time frame of 13 years. He originally started with 20 million dollars of assets under management & in the end, he finished worth 13 billion dollars of assets & after that, he retired. He has given good advice to invest in stocks with little money.

Rules to Invest Like Peter Lynch

Rule 1

- If you study 10 companies, you’ll find one for which the story is better than expected. If you study 50, you’ll find five. There are always pleasant surprises to be found in the stock market.

- What Lynch is getting at with this rule is to study hard as many stocks as you can because it is the person who studies the most stocks and turns over the most stocks wins. This is what Lynch does exactly. He would just sit there & go through as many stocks as possible.

Rule 2

- Everyone has the brainpower to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you should avoid stocks. Investing is predominately about a thing called ‘temperaments’. Why is temperament so important?

- In the 2008 financial crisis, this was the time everyone was panicking & obviously, the world was going to hell as most people thought. But the people who thought properly looked at the facts & not their emotions realized this was the cheapest time to buy stocks because all the fundamentals were going for extremely cheap.

- Those great investors who looked at the facts like Warren Buffett, and Mohnish Pabrai put a lot of money towards stocks. They bought them when they were cheap & made a whole lot of money in the bull markets.

Rule 3

- Your investor’s edge is not something you get from Wall Street experts. It’s something you get from Wall Street experts. It’s something I already have. You can outperform the experts if you use your edge by investing in companies or industries you already understand.

- This is something that Buffett always does. He only focuses on companies that he understands. 30 years ago he started buying ‘Coca-Cola’. Because it’s an easy company to understand, he grew up drinking it as a child. It’s a basic business that sells soft drinks.