What is Oracle Corporation?

Oracle Corporation is a technology company founded by three co-founders including Larry Ellison in 1977.

Oracle is the third-largest software company in the world by revenue & market capitalization. Oracle is the 24th largest public company on the planet by market capitalization.

How does Oracle make money?

Oracle Corporation generates about 70% of its revenue from its Cloud Services and License Support.

This includes Oracle Cloud Infrastructure (OCI), which provides cloud computing services, and Software as a Service (SaaS) applications like enterprise resource planning (ERP), human capital management (HCM), and customer relationship management (CRM).

Additionally, Oracle’s flagship database software offered both on-premises and in the cloud, contributes significantly to this segment.

The company also earns from software license updates and product support, ensuring customers have the latest features and assistance, making this a crucial part of Oracle’s business model.

Oracle Corporation earns approximately 15% of its revenue from hardware.

This includes sales of Oracle Engineered Systems, optimized for running Oracle software, as well as servers and storage solutions.

Oracle Corporation generates about 5%-10% of its revenue from other services, including consulting, support, and advanced customer services.

These services help clients implement, integrate, and optimize Oracle products, providing technical support and software updates, and ensuring smooth and efficient operations for businesses using Oracle solutions.

How much money does Oracle make?

In FY 2022/2023, Oracle Corporation reported revenue of $56.983 billion, marking a 9% increase from the previous fiscal year.

The company recorded a net profit of $18.061 billion, resulting in a net profit margin of 31.7%. This means that approximately 32% of Oracle’s revenue is returned to shareholders as net profit.

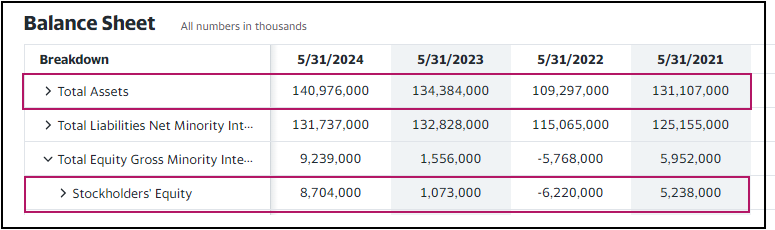

How many assets does Oracle own?

As of May 31, 2024, Oracle Corporation reported total assets of $140.9 billion and liabilities of $131.7 billion, resulting in shareholders’ equity of $9.2 billion.

This gives Oracle a debt-to-equity ratio of 1431%, indicating the company owes 14 times its equity to creditors. This high leverage is significant in the technology industry, reflecting substantial borrowing.

Potential investors should thoroughly analyze Oracle’s financial health and risk factors associated with investing in such highly leveraged stocks.

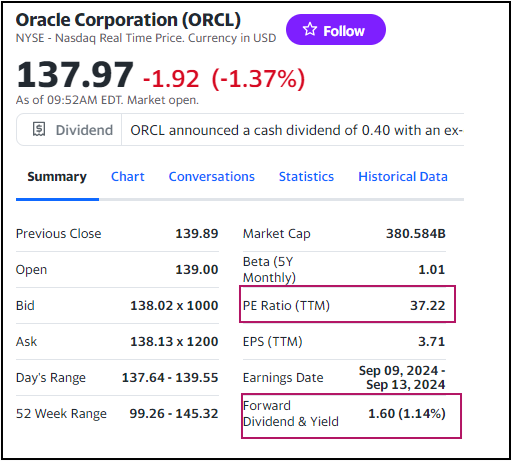

What is the current trading price of the Oracle stock?

Oracle Corporation, trading under the symbol ORCL on the New York Stock Exchange, is priced at $140 per share.

With a current price-to-earnings (P/E) ratio of 38, it would take 38 years to recoup the initial investment if earnings remain constant.

However, Oracle’s earnings have significantly declined from 2021 to 2024, raising concerns about investing in such high P/E stocks.

The company pays $1.60 per share in dividends, yielding 1.14%, with a dividend payout ratio of 43%. This means 43% of Oracle’s earnings are distributed to shareholders, while 57% are retained for growth, representing a balanced approach to business operations.

Who owns the company?

Larry Ellison, the co-founder of Oracle Corporation, owns approximately 42.9% of the company, making him the largest individual shareholder.

Vanguard Group is the largest institutional shareholder with a 5.49% stake, followed by BlackRock, which owns 4.5% of the company.

Ellison’s significant ownership stake gives him substantial influence over Oracle’s business decisions and strategic direction.

Who runs the company now?

Safra Catz has been the CEO of Oracle Corporation since 2019 and initially became a joint CEO in 2014, following Larry Ellison’s transition from the CEO role. She is responsible for overseeing the company’s business operations and has played a significant role in Oracle’s leadership and strategy over the years.