What is Aramco’s company?

Officially the Saudi Arabian Oil Group, formerly Arabian-American Oil Company or simply Aramco is a state-owned public petroleum & natural gas company.

Aramco is the national oil company of Saudi Arabia. Saudi Aramco is the 2nd largest company by revenue & 6th largest company by market cap in the world. Saudi Aramco is the leading net profit-generating company in the world. As you can see Aramco is a financial powerhouse for Saudi Arabia.

Approximately Saudi Aramco produces 9.5 to 10 million barrels of crude oil per day. As of the latest available data, the total global oil production is approximately 100 million barrels per day & Aramco owns 10% of the production which leads them to be the largest daily oil-producing company on the planet.

How does Aramco make money?

As the largest crude oil producer in the world, Aramco’s primary revenue stream comes from extracting & selling crude oil.

Aramco refines crude oil into various products such as gasoline, diesel, jet fuel & petrochemicals. These refined products are sold domestically & internationally.

Aramco also produces & sells natural gas worldwide.

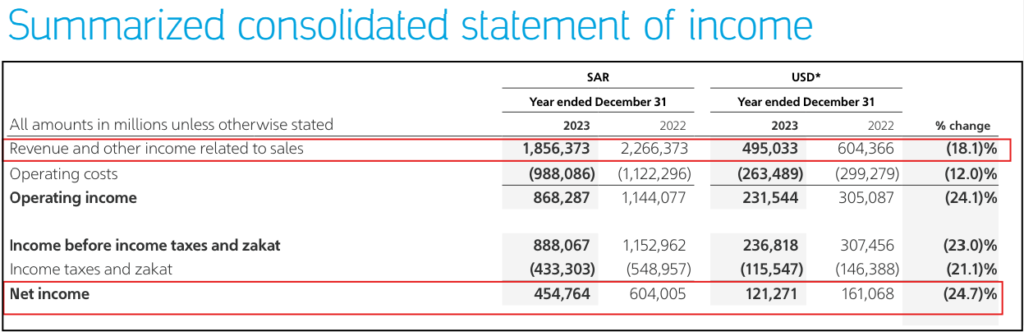

How much money does Aramco make?

For FY 2023 Aramco generated $495 billion In revenue & $121.3 billion in net profit. The net profit margin of the company is 25%, which means for every dollar they generate by business operations the company profits $0.25. When comparing this number with other companies, 25% of the net profit margin is a good number.

The free cash flow of the company is $101 billion which gives you an idea about how rich the company is in cash generating.

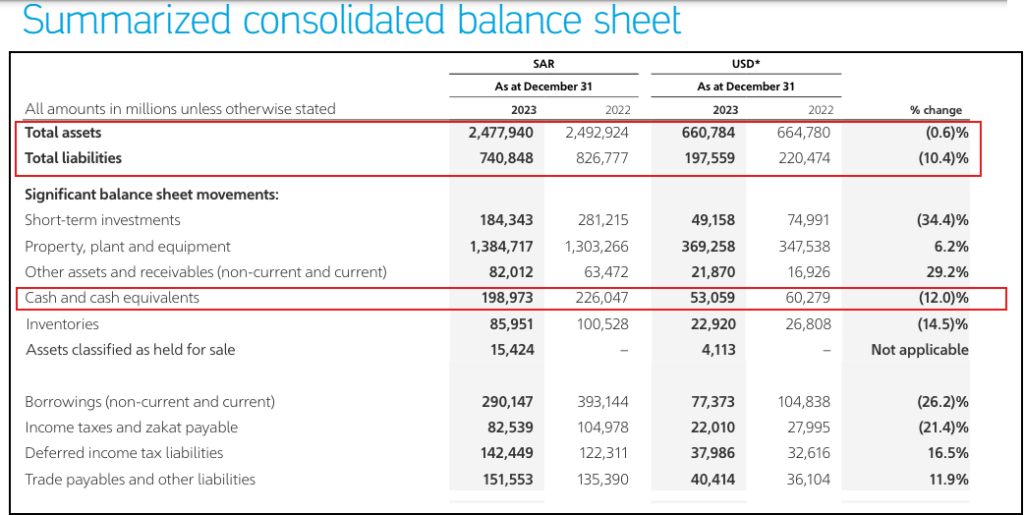

How many assets does Aramco own?

The total assets the company owns are $660.8 billion & the company owes $197.6 billion. Shareholder’s equity is $463.2 billion.

The debt-to-equity ratio is 42%. The debt-equity of 42% represents for every $1 of money invested by shareholders, the company owes only 42 cents in debt. Which means the company is not highly leveraged.

If the company hits some economic crisis like what happened in the 2020 COVID-19 pandemic, Aramco has the financial strength to survive.

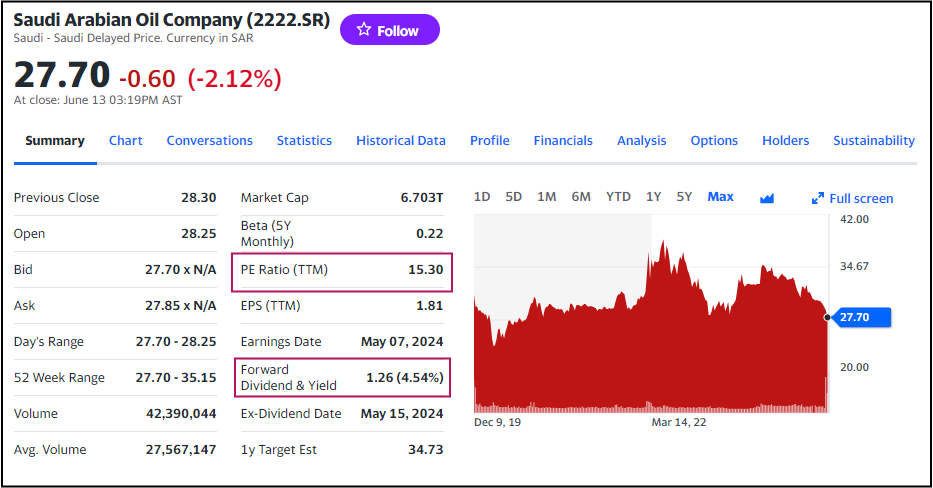

What is the stock price of the company?

Saudi Aramco is listed & trades on the Saudi Arabia Stock Exchange under the symbol TADAWUL: 2222.

The stock is currently trading at 27.70 SAR (Saudi Riyal) ($7.38) & the last twelve months’ earnings are 1.87 SAR ($0.50) per share.

The PE ratio is 15 & the company is paying 1.26 SAR ($0.34) as dividend per share & the dividend yield is 4.54%. PE of 15 means it will only take 15 years to cover our initial investment if the earnings remain the same.

The dividend payout ratio is 67%, which means Aramco is paying 67% of its earnings to its shareholders back & reinvesting 33% of the earnings to grow its business operations.

Who owns the company?

Since its initial public offering in December 2019, a portion (6%) of Saudi Aramco’s shares are publicly traded on the Saudi Stock Exchange (Tadawul).

The largest shareholder of the company is the Government of Saudi Arabia which owns 94% of the company.

Who runs the company now?

Amin H. Nasser is the President & CEO of Aramco & Yasir Al-Rumayyan is the Chairman of the Board of Saudi Aramco.