1. Rich Dad Poor Dad

- Author: Robert T. Kiyosaki

- Overview:

‘Rich Dad Poor Dad’ is a personal finance book that shows the financial philosophies of two different father figures in the author’s life, Robert’s biological father (Poor Dad) & the father of his best friend (Rich Dad). Throughout the book, he shows how his two fathers view money, how they define assets & liabilities, and the difference between having a job & doing a business.

- Key Lessons:

Mindset Over Money

The book discusses the different mindsets between the rich & the poor. Poor Dad focuses on job security & traditional education, while Rich Dad focuses on financial independence & entrepreneurship.

Assets vs liabilities

Assets – Things that put money in your pocket

Liabilities – things that take money out of your pocket

Building wealth involves accumulating assets.

Entrepreneurial Spirit

Rich Dad encourages an entrepreneurial mindset. He always values entrepreneurship over traditional job security concepts. The book encourages readers to find valuable skills & experiences rather than just a paycheck.

The Importance of Investing

Rober Kiyosaki points out investing as a key component of financial success. He explains various types of investments, such as real estate & business.

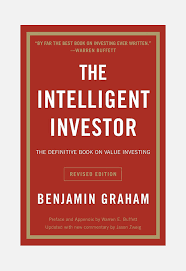

2. The Intelligent Investor

- Author: Benjamin Graham

- Overview:

‘The Intelligent Investor’ is widely regarded as a guide to value investing. Graham, known as the ‘father of value investing’, provides some mental models & guidance to be a value investor. One of the greatest investors of all time, Warren Buffett started his value investing journey by reading this book & under the mentorship of Ben Graham, Warren became a great value investor. Warren recommended this book to all investors.

- Key Lessons:

Mr. Market

Graham introduces the ‘Mr. Market’ character to illustrate market fluctuations. Mr. Market is emotionally unstable, offering daily prices that may be far from the intrinsic value of stocks. The author advises all investors to take advantage of Mr. Market’s mood swings rather than being swayed by them.

Investing vs Speculating

Investing – Based on thorough analysis, ensuring safety principles & adequate returns.

Speculating – Gambling on market movements without sufficient basis in fundamental value.

Margin of Safety

Investing in securities that are priced well below their intrinsic value. This cushion known as the margin of safety helps protect investors from errors in judgment or unforeseen market declines.

3. The Millionaire Fastlane

- Author: MJ DeMarco

- Overview:

‘The Millionaire Fastlane’ book challenges traditional wealth-building advice & presents a unique perspective on achieving financial independence at a young age. DeMarco introduces the basic rules to build a business system that makes money for you.

- Key Lessons:

Financial Paths

Sidewalk – Living paycheck to paycheck

Slow lane – Traditional saving & investing

Fastlane – Entrepreneurship & creating automated business systems

The Most Valuable Asset

Most regular people think money is the most important thing. But highly successful & wealthy ones value time over money. The Fastlaners create automated systems & passive income streams to achieve financial freedom at a young age.

5 Commandments

Before creating a business system entrepreneurs need to consider these 5 commandments to satisfy.

The Commandment of Control – The importance of having full control over key aspects of your business.

The Commandment of Entry – Businesses with high barriers to entry are more difficult to replicate, reducing competition & increasing the potential for profitability.

The Commandment of Need – A business system that solves real problems for its customers. Addresses a genuine need in the market.

The Commandment of Time – Create a business that is not dependent on your time. An automated business system can generate passive income.

The Commandment of Scale – A business system that can expand all over the world.

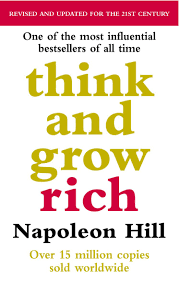

4. Think & Grow Rich

- Author: Napoleon Hill

- Overview:

‘Think & Grow Rich’ is a self-help book that outlines principles for personal achievement & financial success. Based on Napoleon’s study of successful individuals like Andrew Carnegie, Thomas Edison & Henry Ford the book shows secret ingredients to achieve massive success in our lifetime.

- Key Lessons:

The Desire & Faith

A strong desire to achieve your goals & unwavering faith in your ability to achieve your goals is essential.

Imagination & organized Planning

Always imagine & visualize your success & create a detailed action plan to fulfill your dream.

The Master Mind

A network of individuals who share knowledge, support & encouragement. This collective effort helps overcome challenges & accelerates personal growth.

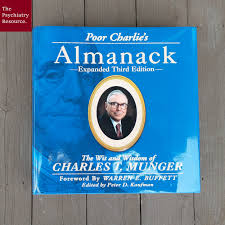

5. Poor Charlie’s Almanack

- Author: Charlie Munger, Peter D. Kaufman

- Overview:

‘Poor Charlie’s Almanack’ is a compilation of the speeches, lectures & writings of Charlie Munger, the vice-chairman of Berkshire Hathway & Warren Buffett’s longtime business partner.

- Key Lessons:

The Latticework of Mental Models

Understanding & applying a wide range of mental models from various disciplines such as psychology, economics, biology, mathematics, and physics to make better decisions.

Lifelong Learning

“Spend each day trying to be a little wiser than you were when you woke up.”

Charlie Munger

Munger stresses the value of lifelong learning & self-education. He encourages reading broadly & consistently to gain new insights & improve decision-making abilities.

Circle of Competence

By focusing on areas where you have the expertise, you can make better decisions & avoid costly mistakes.