Just Save

According to data from the U.S. Bureau of Labor Statistics in 2020 about 20% of Americans aged 65 & older still working.

In 2020, approximately 8.2% of Americans aged 65 & older lived below the poverty line. They need the support of their families or government.

According to the latest statistics, 42% of Americans did not report having savings accounts.

These indicators show that most Americans are unable to retire comfortably even in old age.

To retire comfortably in old age you have to have strong investments & savings.

The problem with society is that people work so hard to make money.

They spend more than 40 years of their life making money.

But when it comes to retirement age still they struggle to retire. Sometimes they are unable to find food to eat, they don’t have the purchasing power to buy the food.

Write a Budget

It is so important that how much money is coming through & how much money is going out & what can I do to reduce expenses & increase income.

After creating a budget allocate a portion of your paycheck for savings & investments.

Try to allocate a minimum of 10% of your income.

If you are an average earner it will be hard to save 10% at an early age but once you start the saving process it is very easy to continue.

Build an Emergency Fund

Set aside at least six months’ worth of living expenses in a savings account.

It will give you the strength to survive in a bad economic or social environment.

In 2020 no one expects a lockdown all around the world. People weren’t able to operate their daily routines as usual.

Most people didn’t get the paychecks or got a portion of the paycheck. In such a situation having an emergency fund gives you the ability to live comfortably. You have six months to find another income source or for the next paycheck.

Invest

Compound interest

One of the greatest investors of all time Warren Buffett became a billionaire by using this compounding effect.

He started to invest in the stock market at age 11. He started his compound engine works at a very early age.

We need to take advantage of compound interest by investing as soon as possible.

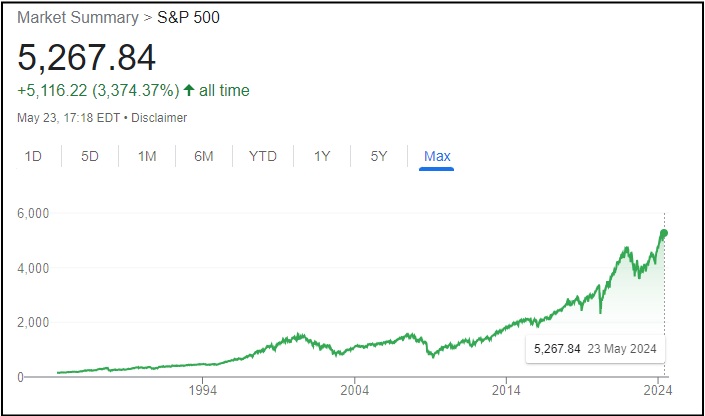

As retail investors stock market is a good platform to invest our money. If you don’t have the knowledge or interest to invest in individual stocks you can invest in S&P 500 index.

Over the last 10 years, the S&P 500 has given a 10% annual return to its investors.

Retirement

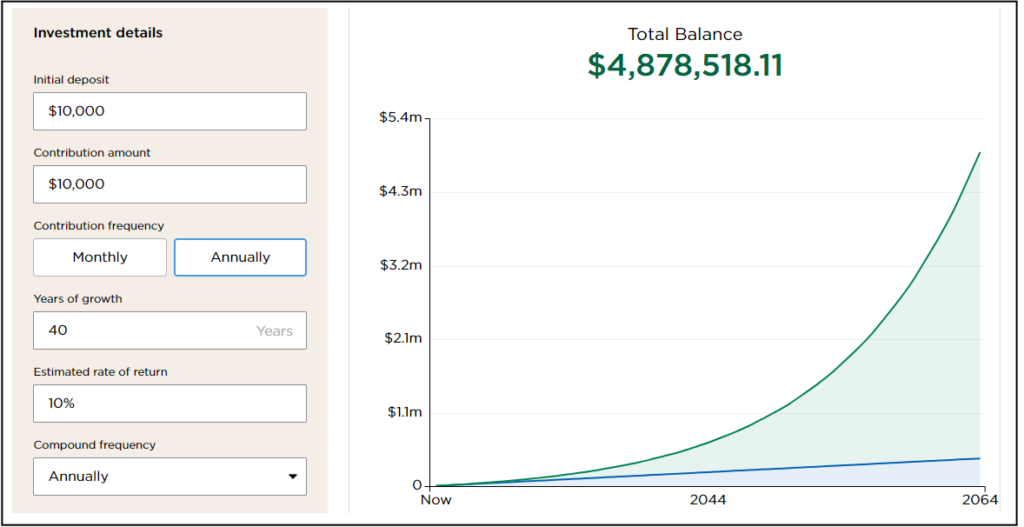

The average salary of an ordinary American citizen in 2024 is $63,795 per year & average living expense for a single ordinary person in the US is $40,859. Let’s say you save $10,000 per year & you invest in an index like the S&P 500 for the next 40 years & you start with a $10,000 initial investment.

After 40 years your investment has become $4.878 million & with such investment you can retire comfortably.