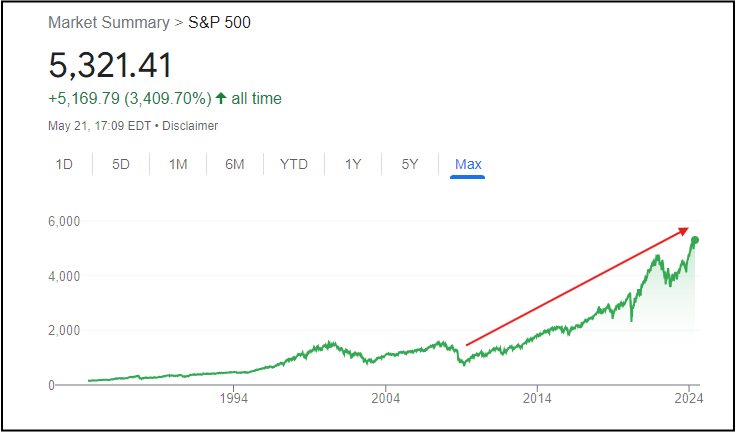

What happened in the last 15 years?

It has been 15 years since that last stock market crash & as investors, should we invest our money into stocks or put it all into cash & wait for the next market crash? The S&P 500 hit many all-time highs consistently in the past few months. Some big companies broke the $1 trillion market cap level. So, as you can see this is a very long bull run & still going.

Where should we put our money?

In such a scenario, we need to consider different investing options that we have available with our money. There are some asset classes in which you can put your money, gold, bonds, real estate, or stocks.

1. Gold

How does gold behave in a market crash?

If we look at gold it is known as a hedge. Investors buy gold to protect their wealth in an economic recession. People believe that gold is a protection against stock market crashes. When stocks are struggling gold holds its value & often increases in value. People need a safe investment when they panic. Gold is known as a safe investment.

Is gold a good investment?

But you should only put a small portion of your portfolio in gold because gold doesn’t do anything, it doesn’t produce anything. It just sits there & you have to hope there people will pay more for your gold in the future.

2. Stocks vs Bonds

What is a bond?

Another type of investment you can put your money in is bonds. A bond is a fixed-income instrument where investors lend money to a government or company at a certain interest rate for an amount of time. Bondholders are known as creditors. Companies, states, or governments issue bonds to fund their future or current projects.

Which asset category should we select?

When it comes to bonds & stocks the most important thing to do is look for the highest investment yield. The current 10-year Treasury bond rate is 4.42%. identifying the investment yield of a bond is very easy but identifying the return of stocks is not easy.

How do we get the investment return of stocks?

We have to do some basic calculations to get the investment return of stocks. The PE ratio of the S&P 500 is 24.79 now. What we need to do is get the inverse of the P/E ratio. We can get an inverse by just dividing 1 by 24.79 & we get a 4.03% return.

Here we need to consider earnings growth also. We can expect the GDP growth of the USA will be similar to the growth of earnings. The current GDP growth of the USA is 1.9%. If we add those two things together we get 4.03% + 1.9% = 5.93%. We can expect stocks will give a 5.93% investment yield.

When we compare this 5.93% return to the bond return of 4.03% the stock return is higher. When we compare the returns between these two groups of assets we’re going to be picking stocks for the long term.