What is Southwest Airlines?

Southwest Airlines is one of the low-cost airline operators in the United States.

Southwest Airlines is the third largest airline in North America based on passengers flown. This airline provides scheduled air transportation in the United States & near international markets.

Southwest Airlines currently has 817 aircraft & operates with 66,000 employees.

How much money do they generate?

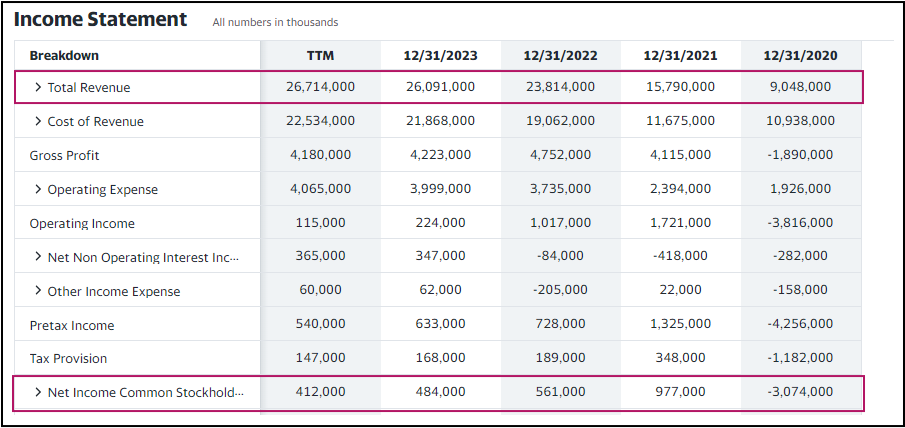

For FY2023 Southwest Airlines recorded $26 billion in total revenue & $484 million in net profit.

The net profit margin of the company is 1.9%. It is widespread in the airline industry that airlines operate with very tiny profit margins.

The problem with operating with such tiny margins is that once they hit some economic setback like what happened in 2020, with total lockdowns all around the world due to the COVID-19 pandemic they cannot make a profit. In 2020 all airline companies recorded a loss.

The revenue has increased from $9 billion in 2020 to $15.8 billion in 2021 to $23.8 billion in 2022 to $26 billion in 2023.

The net profit has increased from negative $3 billion in 2020 to $484 billion in 2023. The company management was able to turn that loss into a net profit.

How many assets, debt & capital do they have?

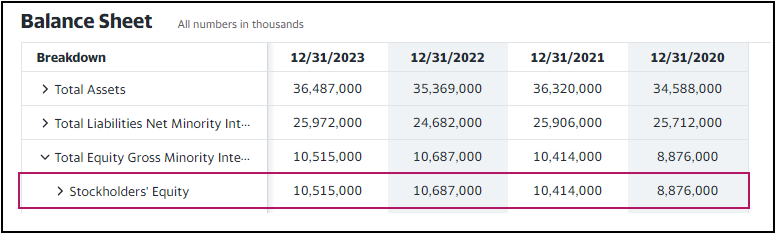

Southwest Airlines has $36.5 billion in total assets & $26 billion in total liabilities. Shareholders’ equity stands at the $10.5 billion level.

The debt to Equity figure is 247% which tells us that the company owes its creditors 2.5 times of equity.

As I mentioned earlier with such high numbers when airlines hit economic recession it is very hard to survive. Even if the company made a loss they still have to pay the debt. Having more debt means they have to pay high interest also.

Southwest Airlines has increased its shareholders’ equity value year after year. From $8.8 billion in 2020 to $10.6 billion in 2023.

How much does a Southwest stock?

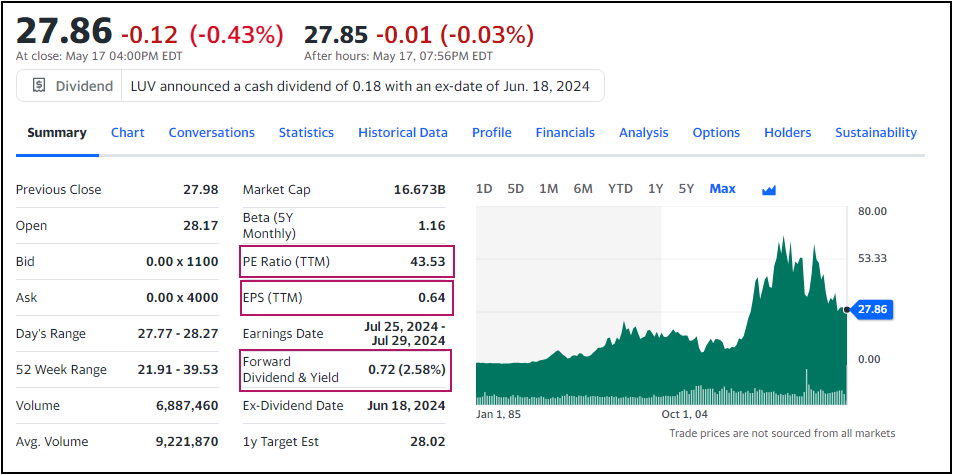

Southwest Airlines Co. trades under the LUV ticket symbol on the New York Stock Exchange & currently trades at $28 per share with a $17 billion market cap.

Earnings for the lFY2023 is $0.78 & with the current price the PE ratio is 36. The PE of 36 means that with this EPS investors would take 36 years to cover their initial investment.

The company has paid a $0.76 dividend per share for its investors & it almost 97.5% of the earnings.

The dividend payout ratio is 97.5% & dividend yield is 2.71%.

The dividend yield is a reasonable one in this economic environment but paying 97.5% of total earnings back to their shareholders is somewhat a problem. Paying 97.5% means that the company has left only 2.5% of its earnings for its business expansion. It is not a good sign anyway.

Who owns the company?

Vanguard Group is the largest shareholder of the company and they own 11.29% of the company.

Robert E Jordan serves as the President & CEO at Southwest Airlines. Bob is a 36-year-old, younger CEO who has started his career as a programmer.

The vision of the company is to be the world’s most loved, most efficient & most profitable airline.