Ray Dalio’s Investment Strategy: All Weather Portfolio

As investors, we always ask how we structure our portfolio for maximum returns at as low risk as possible. We wonder how many stocks we need to keep in our portfolio. How much percentage do we allocate to each stock? Which asset classes do we need to focus on? When economic recession hits how do we rebalance our portfolio? These are some questions we always need to find answers to. As the largest hedge fund manager in the world, Ray Dalio has introduced his investment strategy to the world & it will give proper answers to your questions.

What are the asset classes we need to focus on?

Ray Dalio is a well-diversified investor, he has invested his money in stocks, gold, treasury bills & bonds & other asset classes. When it comes to stocks he selects stocks of different industries in different countries.

“The magic is you only need to do this simple thing. The simple thing is to find 15 or 20 good uncorrelated return streams. If you can do this you can improve your return to risk ratio by a factor of 5.”

Ray Dalio

If you are looking to build a well-diversified portfolio, buy stocks that aren’t strongly related. You can buy stocks in different industries like technology, banks, insurance, food & beverage, etc. These industries are not likely to close together & therefore your risk will be lowered.

Risk vs Return

When it comes to investing most people only focus on how much gains they can get, they ignore the risk. But for all smart investors in the world, the first thing they look at before they invest is risk. The main thing they consider is how much am I going to lose if this investment doesn’t work. Like Warren Buffett his first rule to investing is ‘Don’t lose money’ & his second rule is ‘Don’t forget rule one’. What he is trying to get at is manage his risk well. He always focuses on the downside of the investment.

What is the best asset class to invest in?

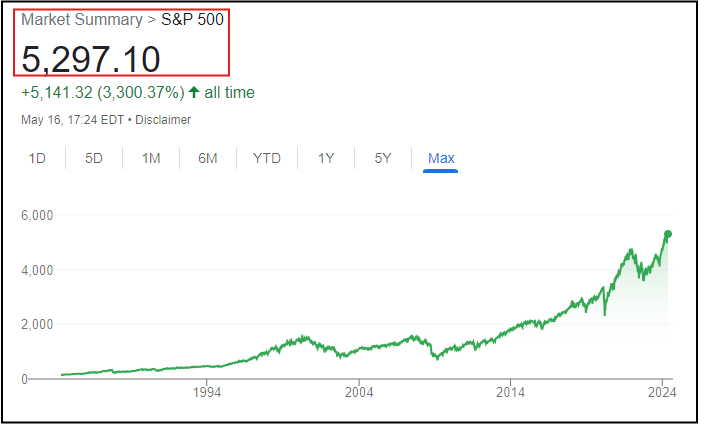

Throughout history, equity has offered the highest returns. That is how Buffett became the richest person on the planet, not through bonds, not through gold, not through real estate, not cash, it was through equities. Ray Dalio exposed his equity to the USA & other developed markets.

Equities in emerging markets behave differently to develop markets. These equities do well in a high-inflation environment. A well-diversified portfolio like Ray Dalio’s has both equities in developed & emerging markets.

How to diversify?

According to Ray Dalio to be well diversified you need more than just equities. Gold is a big component of Dalio’s portfolio. In an economic recession environment keeping gold is good. It protects your net worth. He likes to keep some cash aside also. He always says that ‘cash is the king’. He diversifies his portfolio through asset classes such as commodities, inflation-protected bonds, long long-duration treasuries. If you are a low-risk taker & don’t want to rebalance your portfolio frequently you can use Ray Dalio’s investment strategy. A well-diversified portfolio gives you a very comfortable environment for your mind.

Pingback: How To Invest Your Money Successfully - financialcloning.com